Why AutoCount is the Best E-Invoice Solution In Malaysia?

AutoCount offers the most reliable and innovative e-invoicing solution for businesses in Malaysia, ensuring seamless compliance with the latest regulations. With features like queue management, powerful onboarding functions, and industry-specific controls, AutoCount helps businesses transition to e-invoicing effortlessly, saving time and reducing errors. Stay ahead in the evolving regulatory landscape with AutoCount’s proven stability and user-friendly portal.

Introduction

The introduction of e-invoicing in Malaysia is a major milestone that promises to streamline financial transactions, enhance tax compliance, and improve overall business efficiency. As a result, as businesses gear up to comply with this new requirement, finding the right e-invoice solution becomes crucial. AutoCount stands out as the best e-invoice solution in Malaysia, thanks to its innovative features, robust functionality, and proven reliability.

Hence, you can watch the Introduction to AutoCount E-Invoice in Chinese to gain a basic understanding of AutoCount E-Invoice

AutoCount E-Invoicing Portal (AIP)

AutoCount’s e-invoicing portal, known as the AutoCount E-Invoicing Portal (AIP), offers a comprehensive solution for managing e-invoices effectively. Here’s why AIP sets AutoCount apart from other accounting systems:

Queue Management for LHDN MyInvoice Portal Submissions

AIP allows AutoCount users to queue their invoices before posting them to the LHDN MyInvoice portal. This feature is crucial because the LHDN portal may experience downtime, and without this queuing system, users would need to repeatedly attempt resubmission, wasting valuable time.

Powerful Onboarding Functions

AIP includes powerful onboarding functions that simplify the e-invoicing process.

For a more detailed understanding, you also can read our comprehensive E-Invoice Guide and Preparation for AutoCount Users.

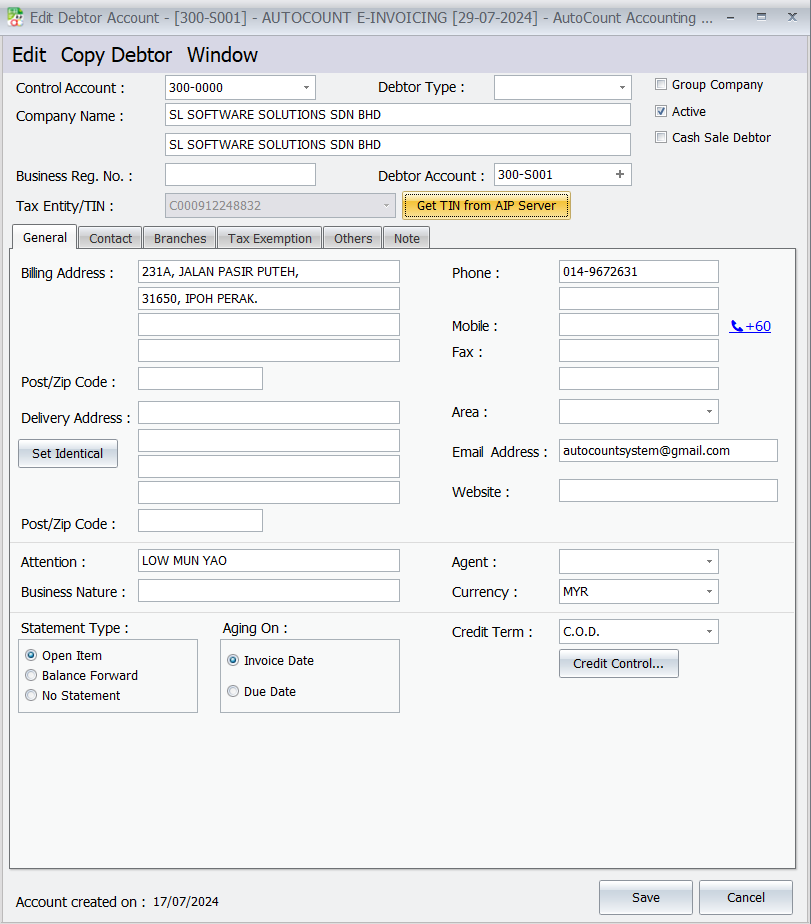

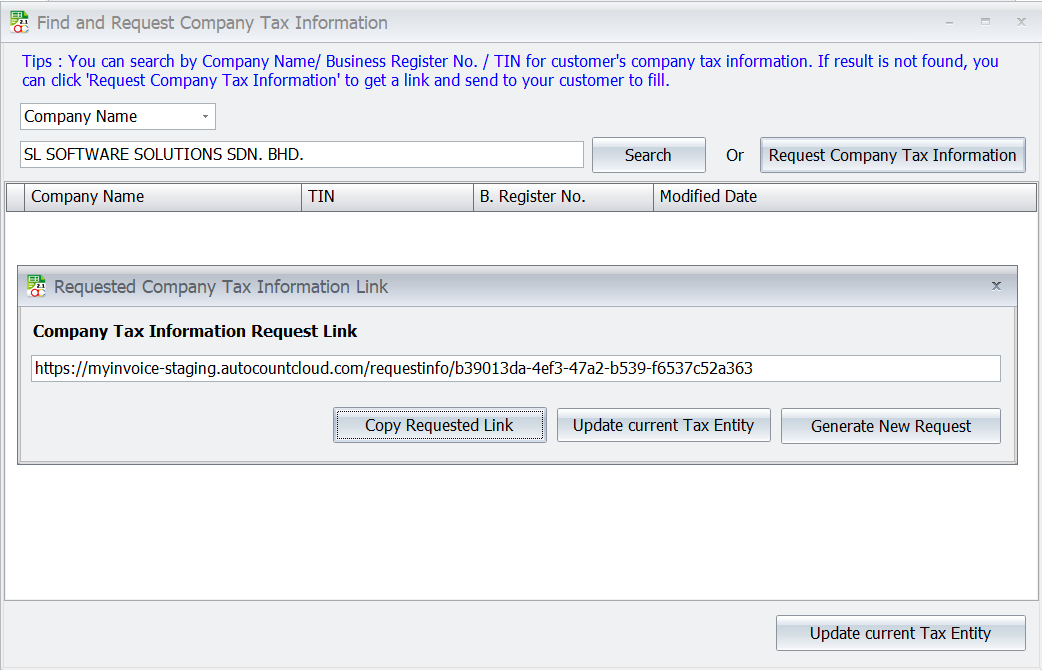

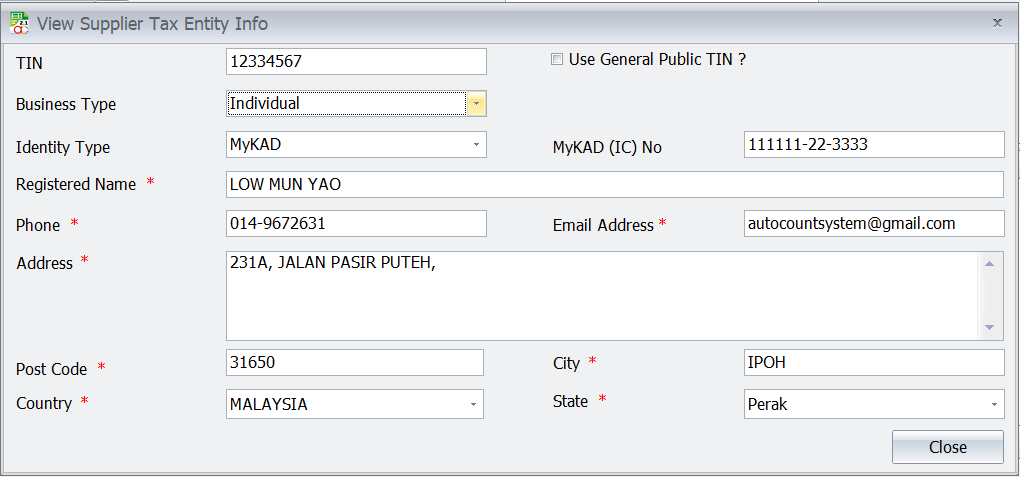

a) Storage of Tax Identification Number (TIN) and Buyer Info

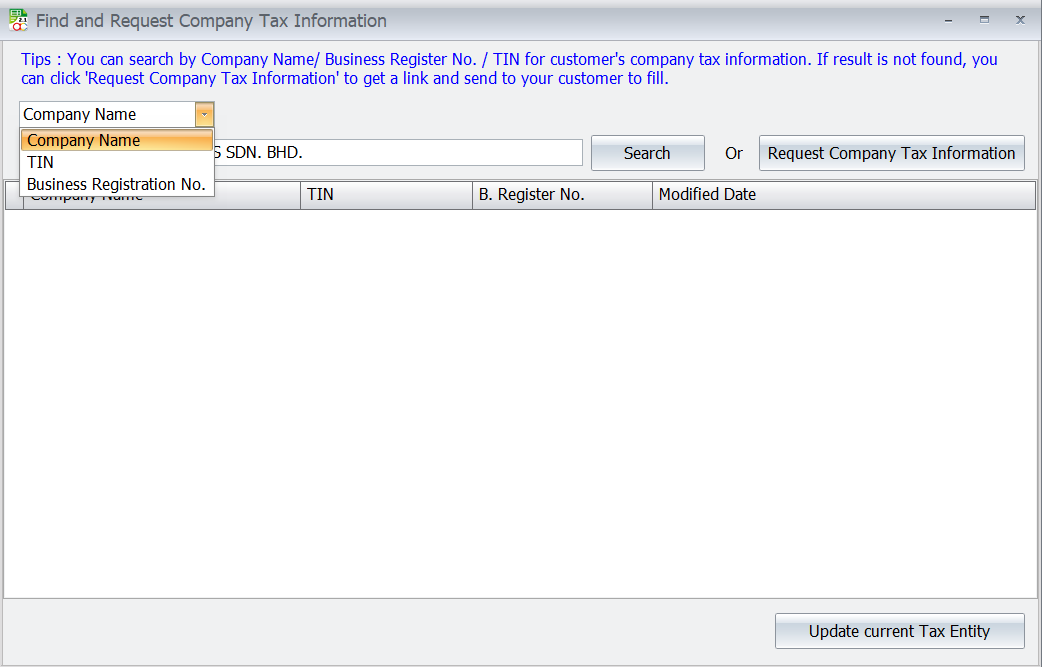

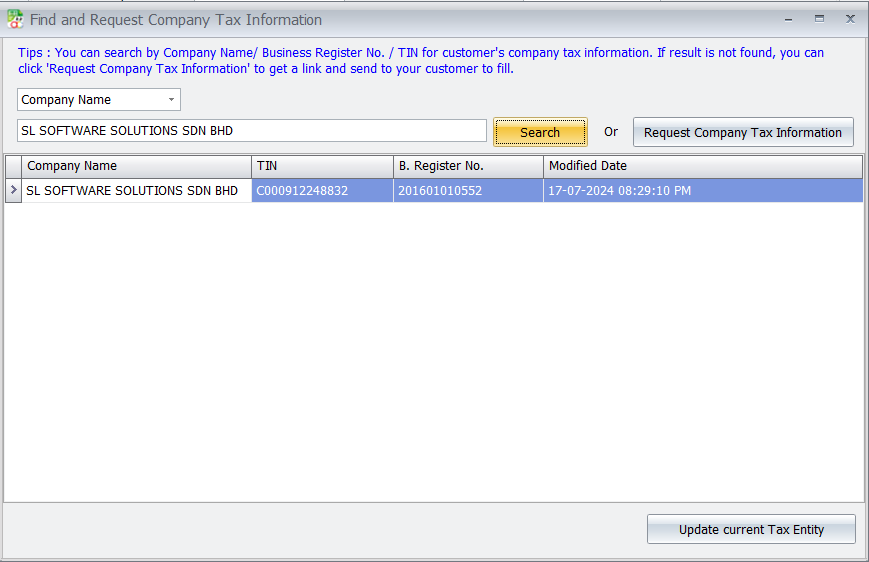

Users can store essential customer details required for e-invoicing validation in AIP

- Search from AIP Server

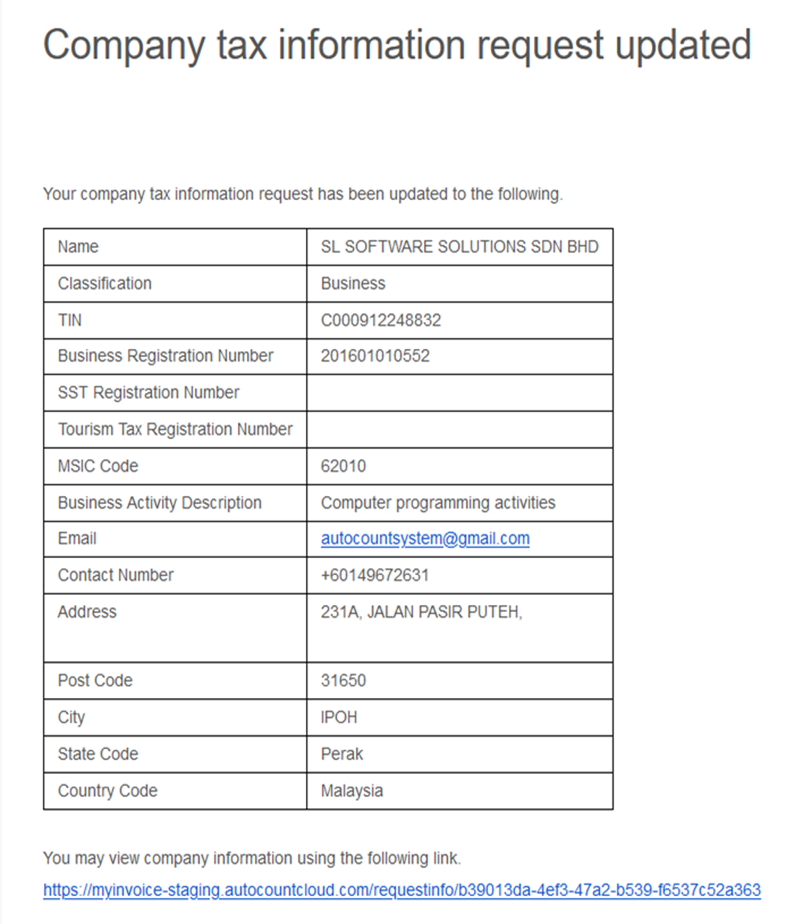

- Email notification will be sent to inform after customer or supplier to fill in details

- Generate Request Link

- Support Searching by Company Name, TIN, and Business Registration No.

b) Customer Information Sharing

Users can download customer information from the AIP server if they share the same customer. This reduces redundancy and ensures accuracy.

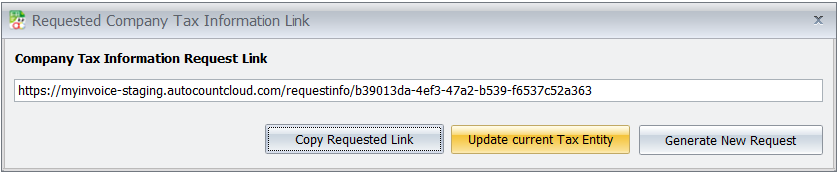

c) URL for Customer Data Submission

If customer information is not found in AIP, users can generate a URL and send it via email or WhatsApp to request the necessary details from the customer. Customers can also update their information through this URL.

Handling Consolidate E-Invoice Requests

For customers who initially do not request an e-invoice but later decide to do so, AIP offers a seamless solution:

- When consolidate, receipt / bill / invoice reference number must be included in the "Description" field.

- Such consolidated e-invoice must be submitted to IRBM within 7 days of the following month.

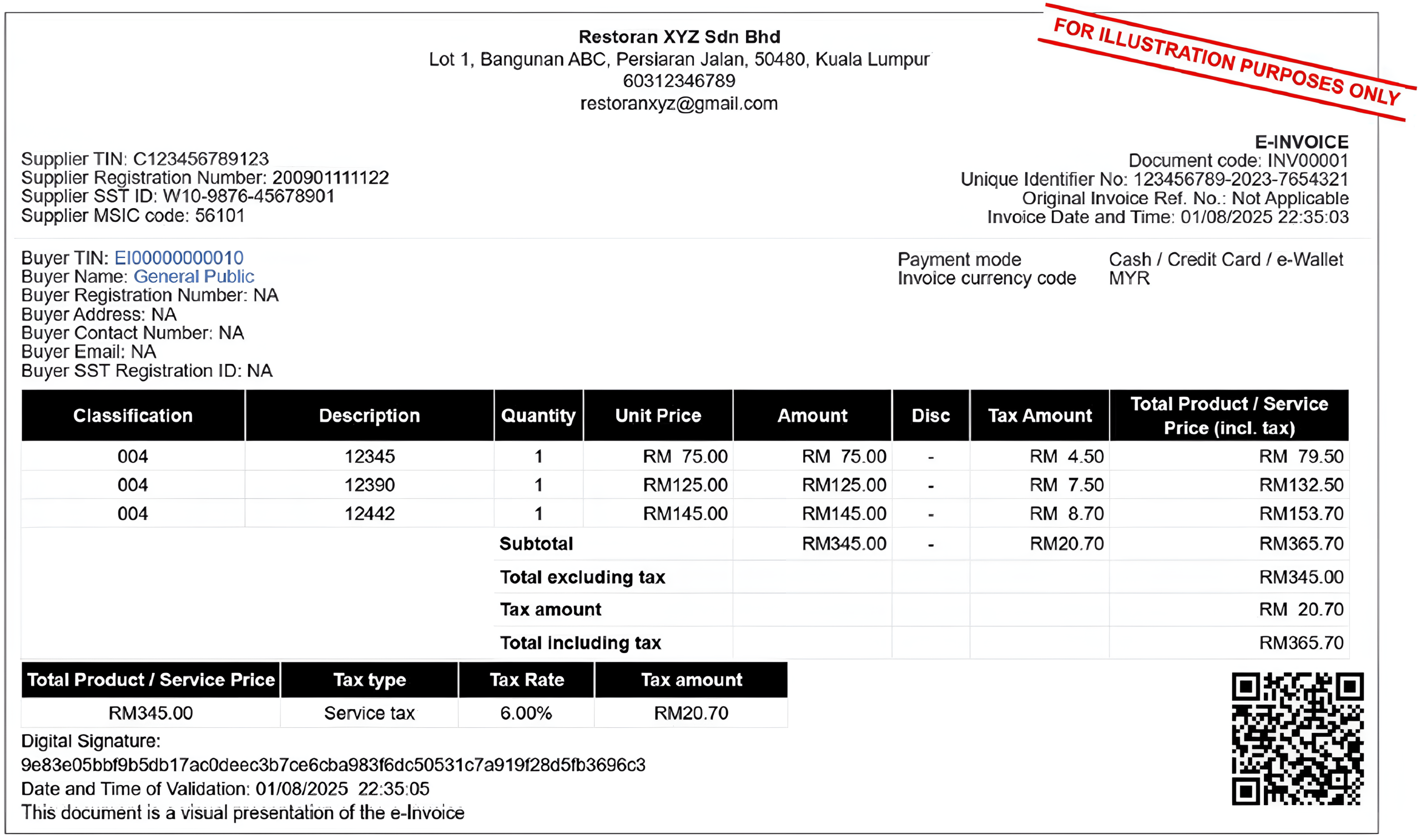

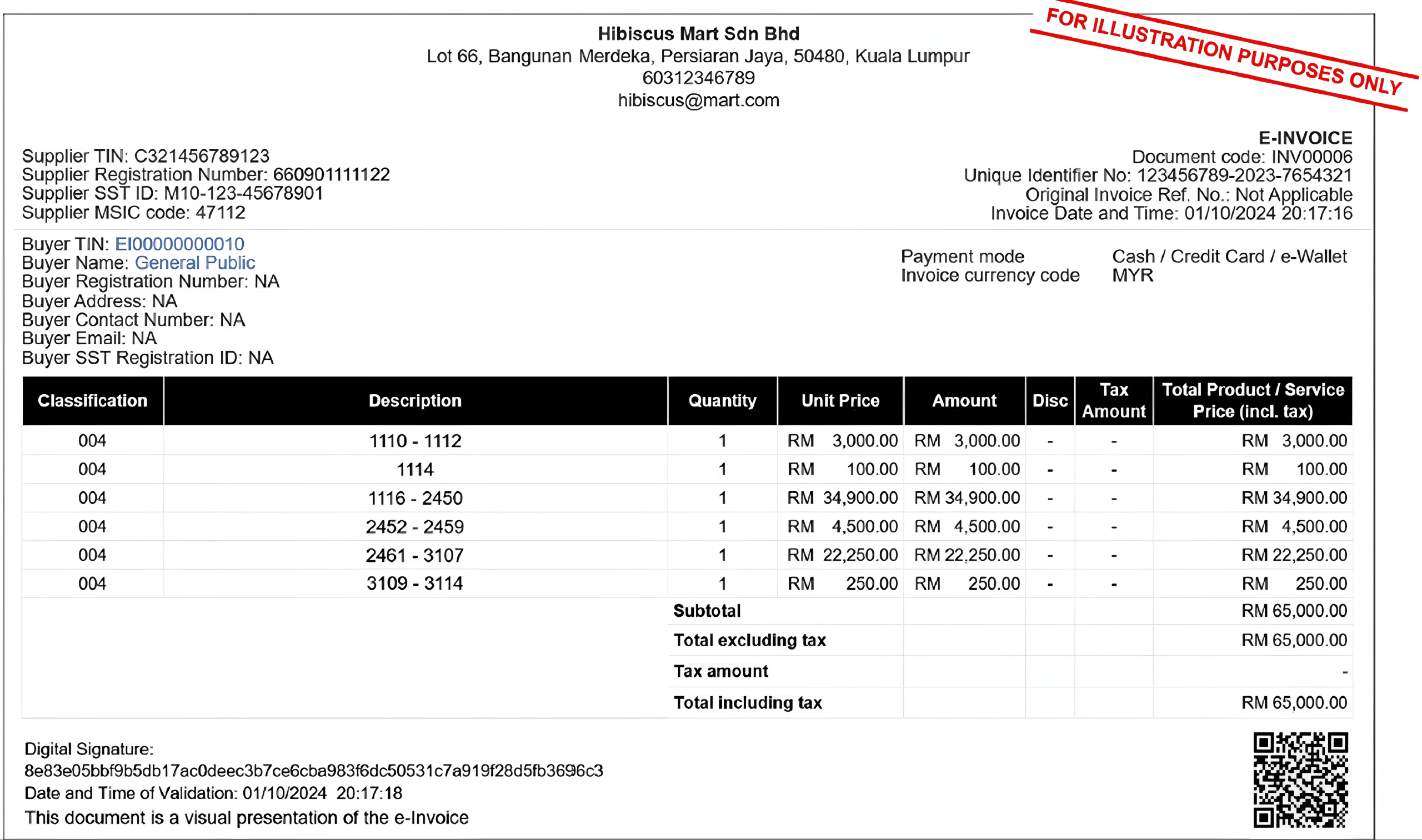

Here is an example of Consolidate E-Invoice:

a) QR Code for Post-Transaction E-Invoice Requests

Customers can scan a QR code from their normal receipt to access AIP and fill in their TIN information. A standard e-invoice is then generated and emailed to them after validation by LHDN. This request is only available within the same month of the transaction.

b) Duplicate Submission Control

AIP manages and prevents duplicate submissions of consolidate e-invoices and post-request standard e-invoice documents.

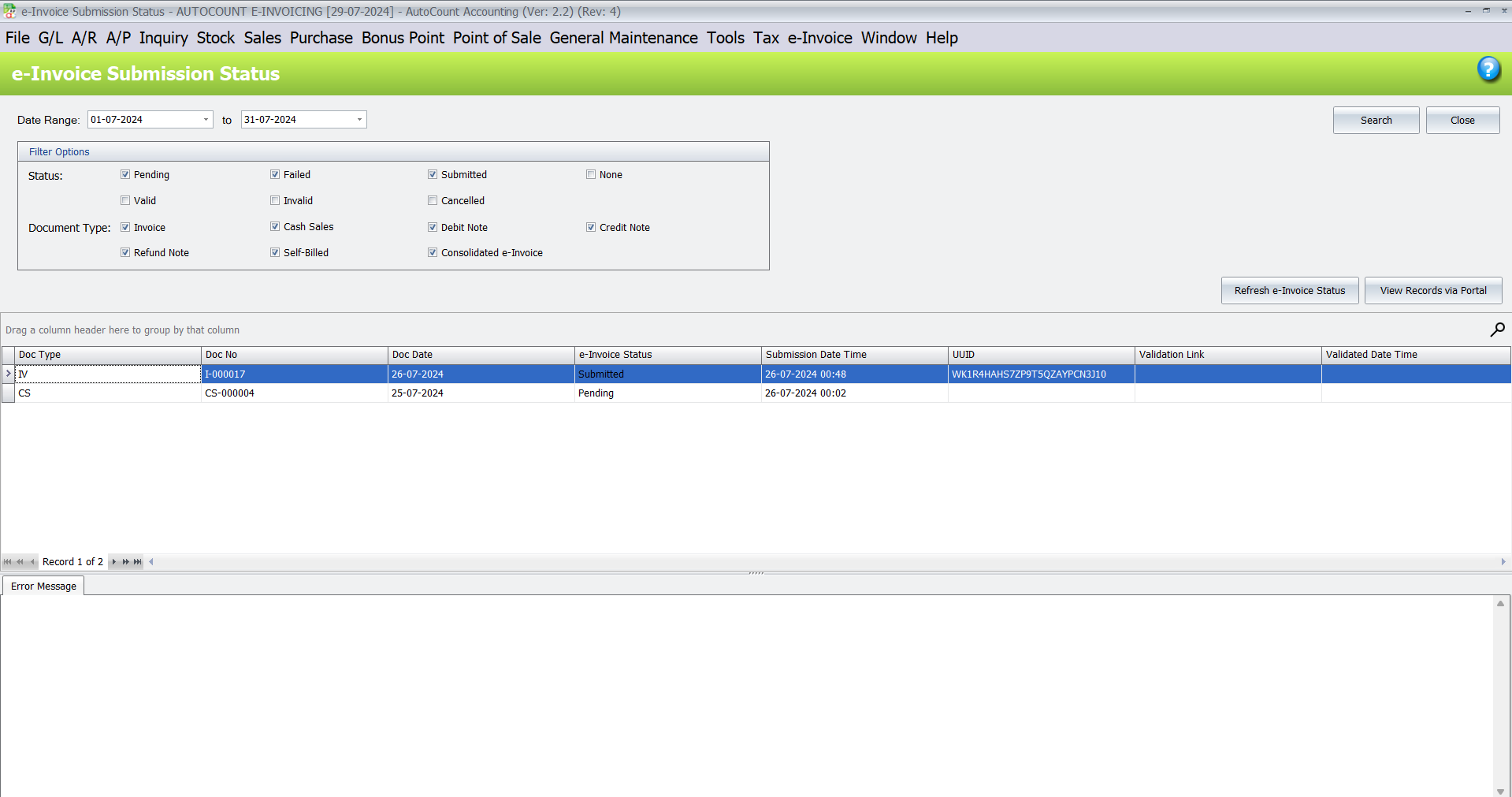

Submission Status and Invoice Printing

AutoCount users can log in to AIP to check the status of their submissions and print invoices directly from the portal, providing a centralized and efficient way to manage e-invoices.

First Mover Advantage

AutoCount is the first accounting system in Malaysia to offer an e-invoicing portal, giving it a significant edge over competitors. Moreover, while other accounting systems are only now beginning to follow suit, but AutoCount’s early start and established experience in cloud-based solutions provide unmatched stability and reliability.

Proven experience

AutoCount has a history of developing systems such as AutoCount Accounting, AutoCount POS system, and AutoCount Cloud Payroll, unlike many local accounting systems that lack this experience. Moreover, this background ensures that AutoCount’s e-invoicing portal is not only stable but also capable of meeting the demands of Malaysian businesses within the tight timeframe for e-invoicing implementation.

Advanced features and deep business understanding

Beyond the AIP, AutoCount’s e-invoicing solution is designed with deep insights into various business needs. Thus, it is the most suitable choice for diverse industries.

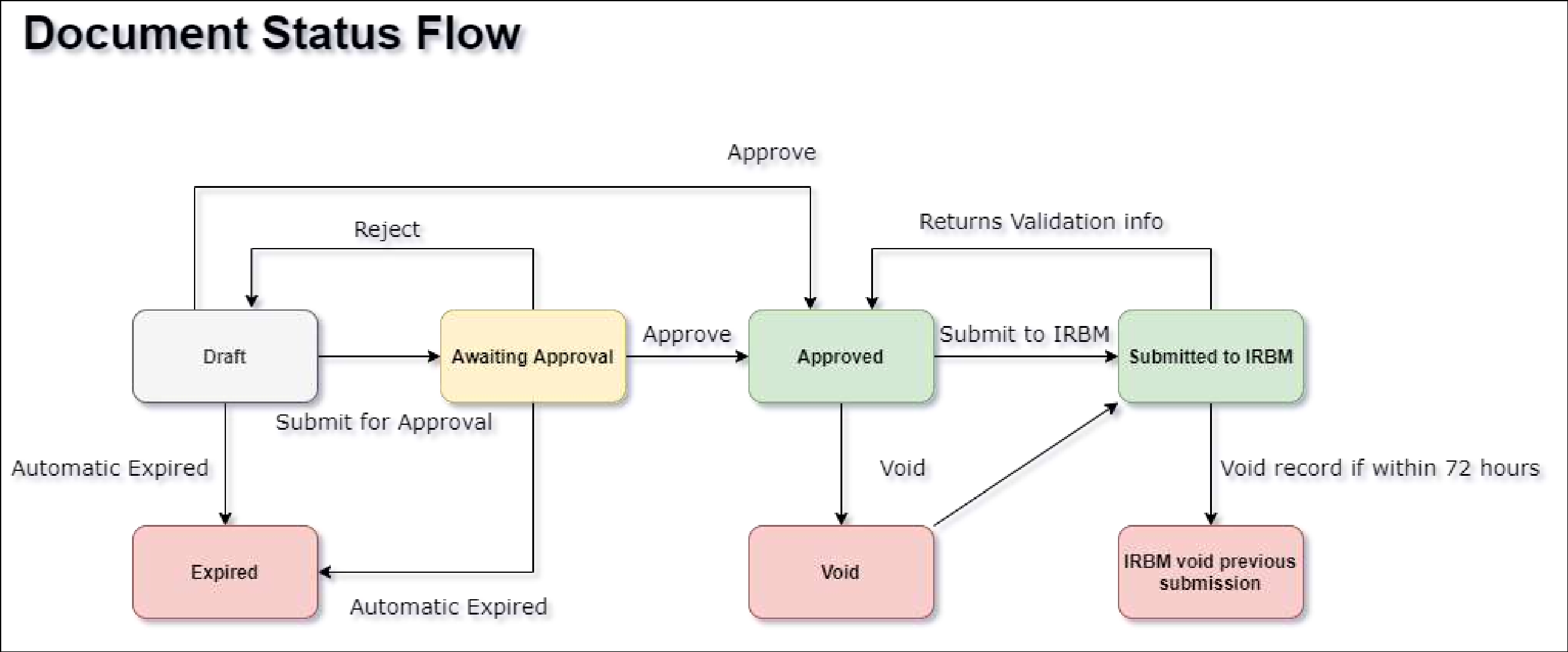

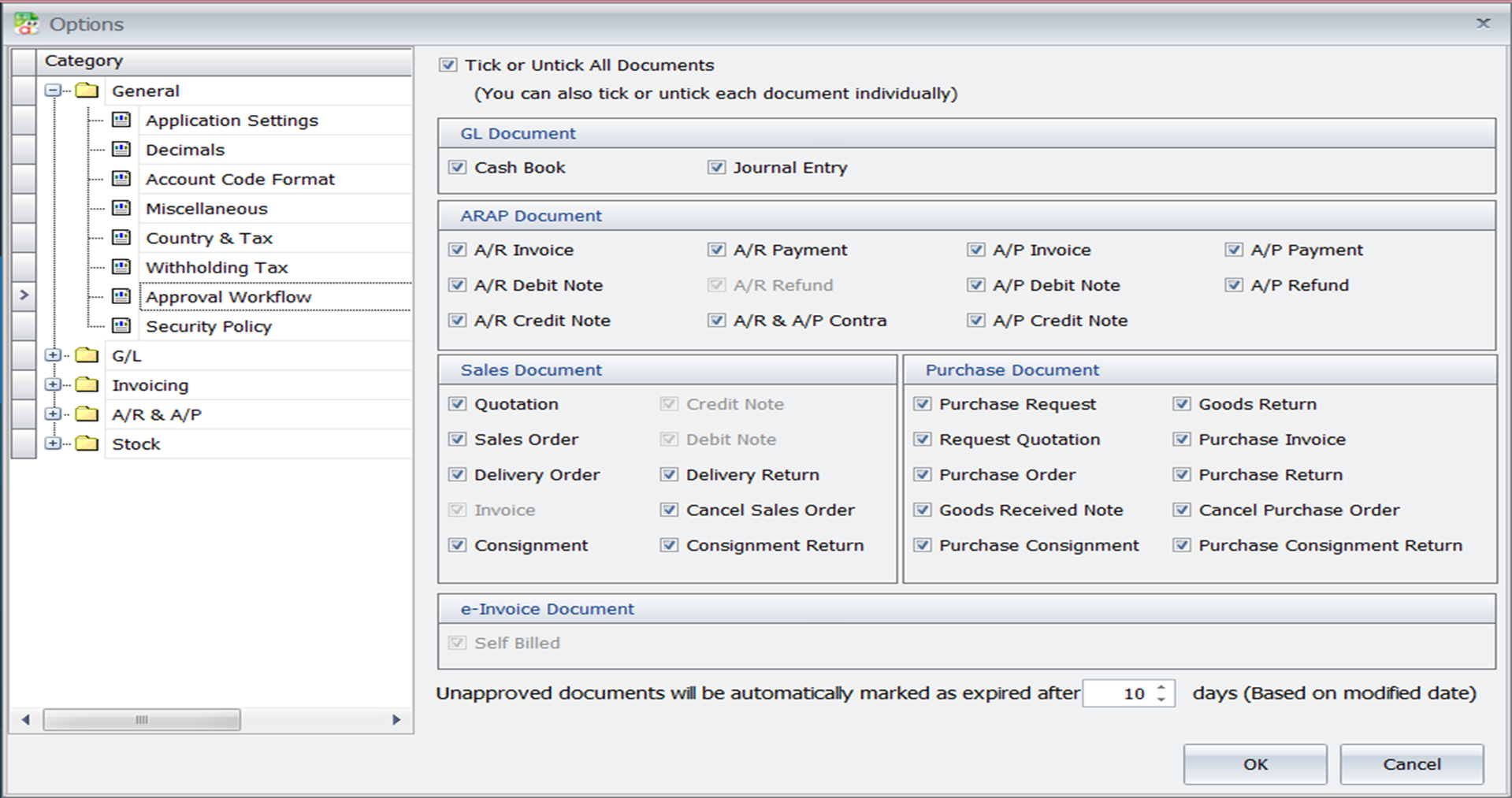

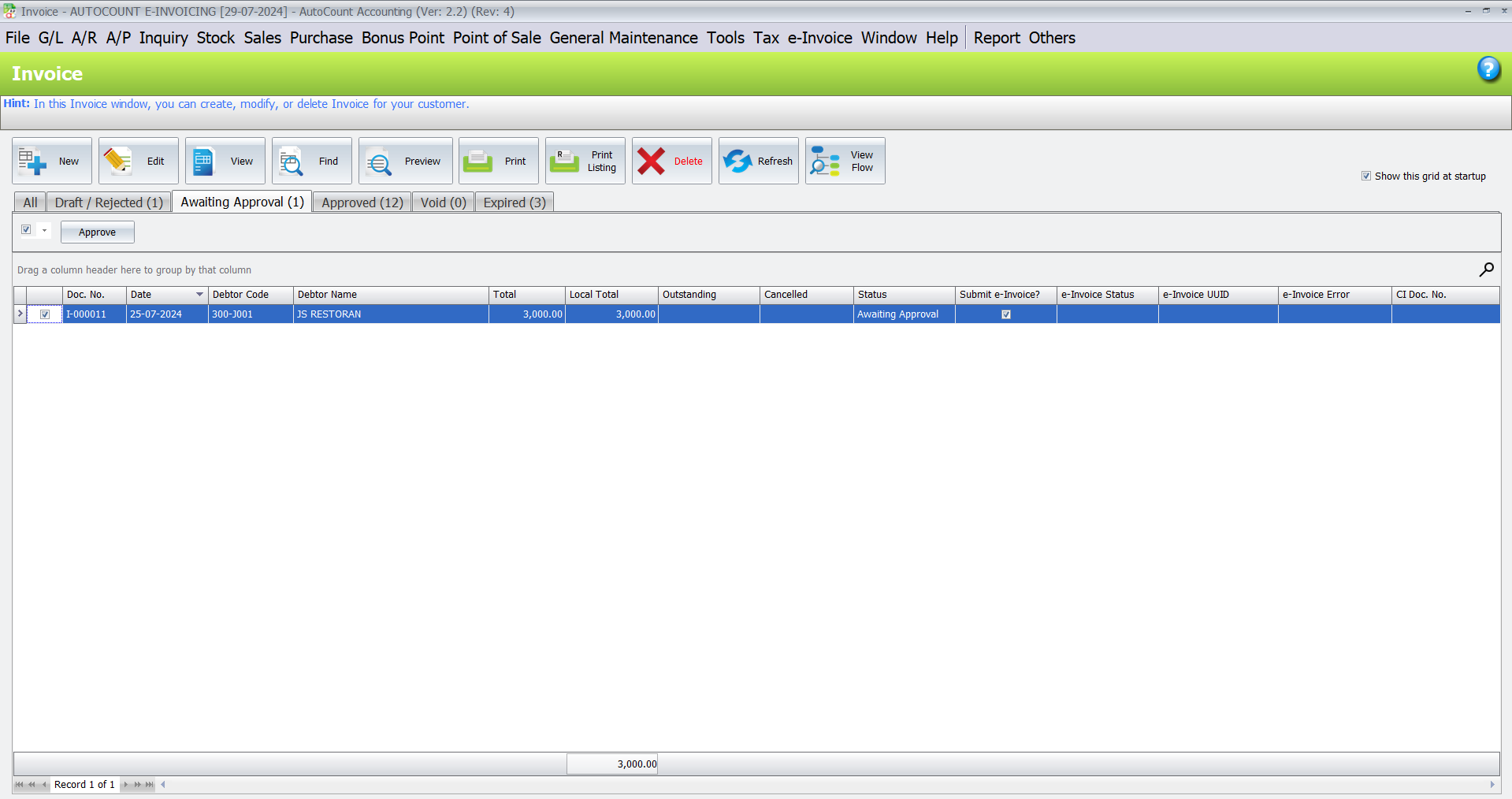

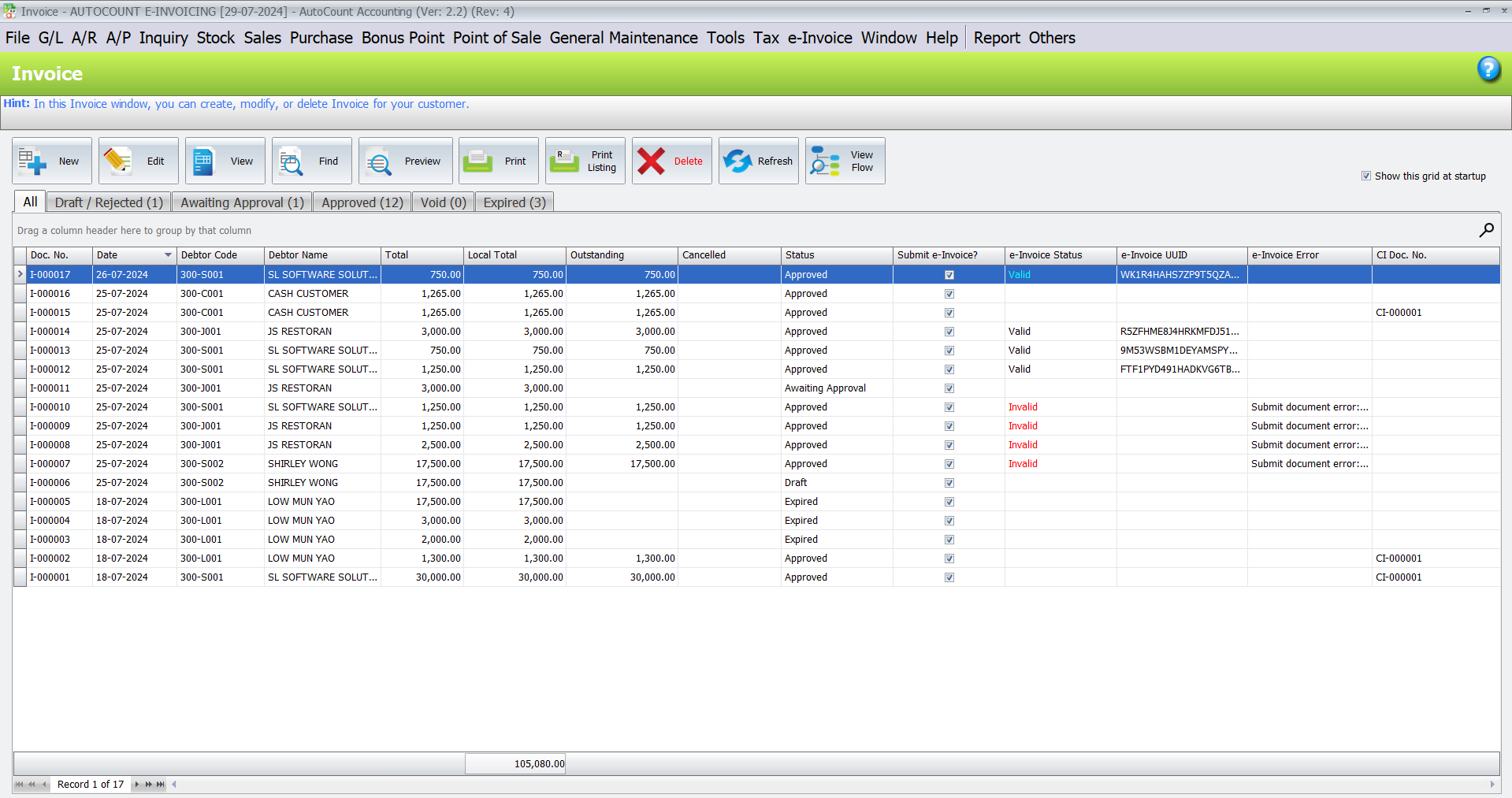

New Enhancement – Approval Workflow

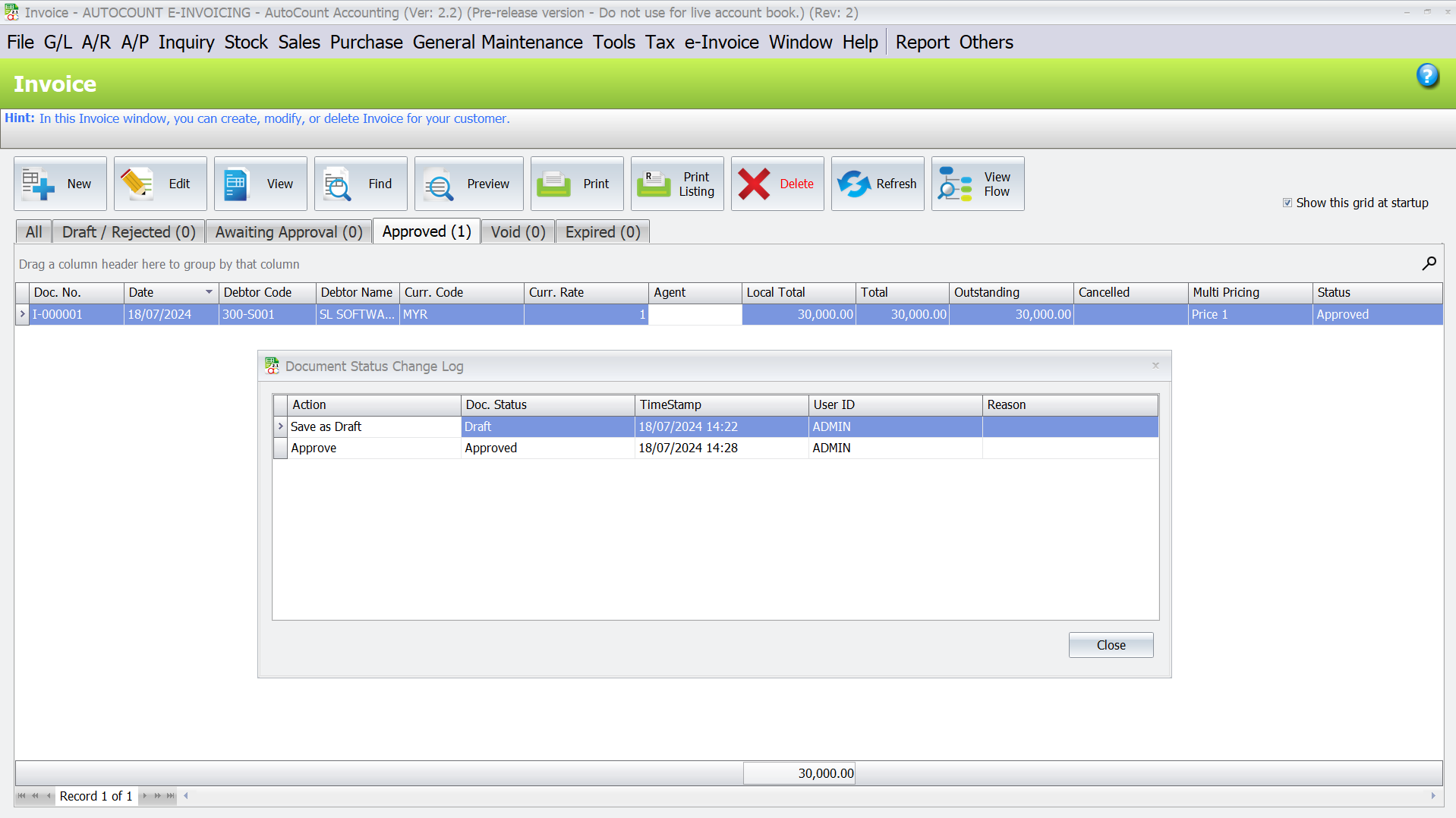

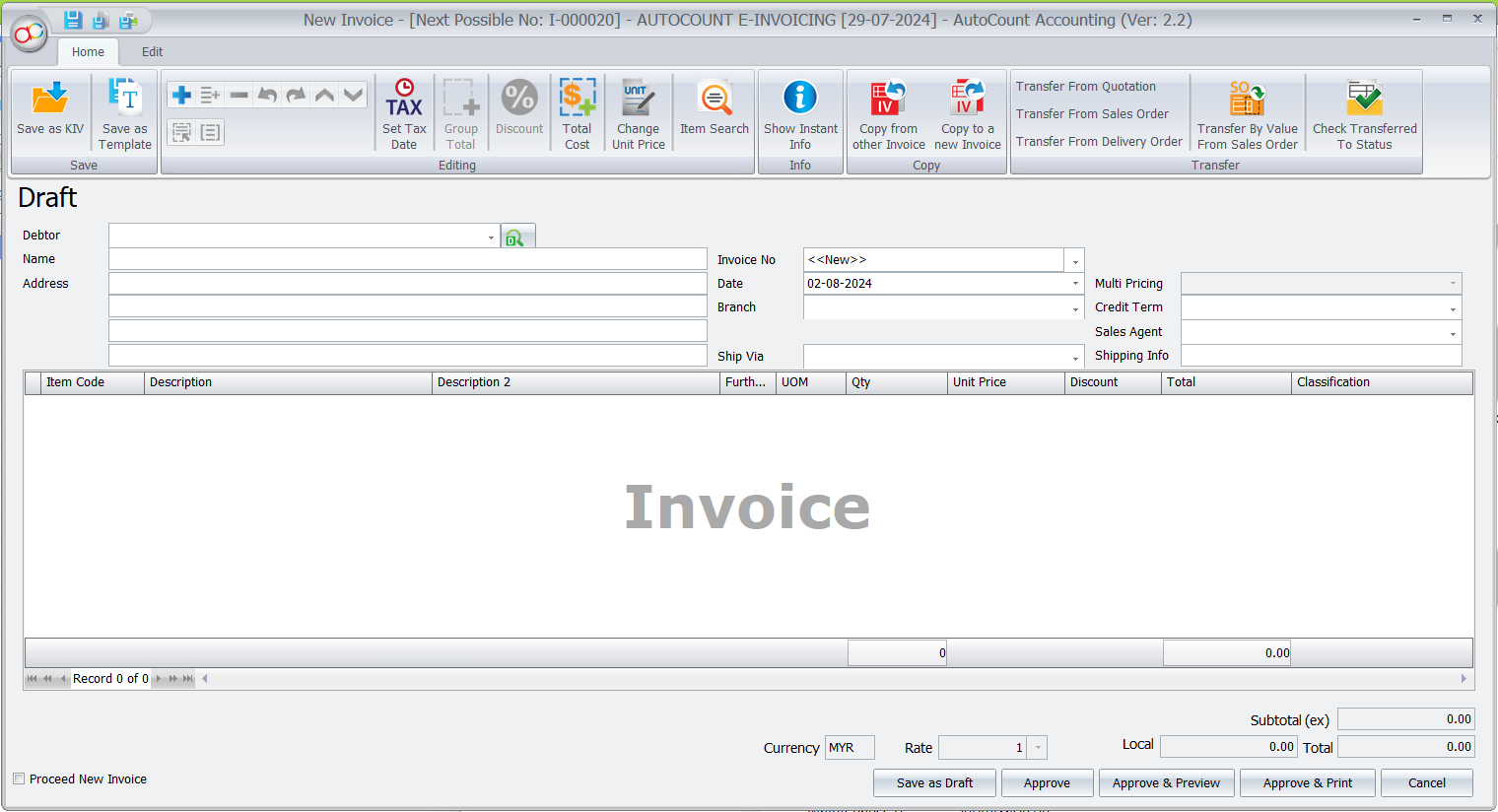

Invoices can be saved as drafts before being posted to the LHDN portal for validation. This feature allows for an approval workflow, providing flexibility and control over the invoicing process.

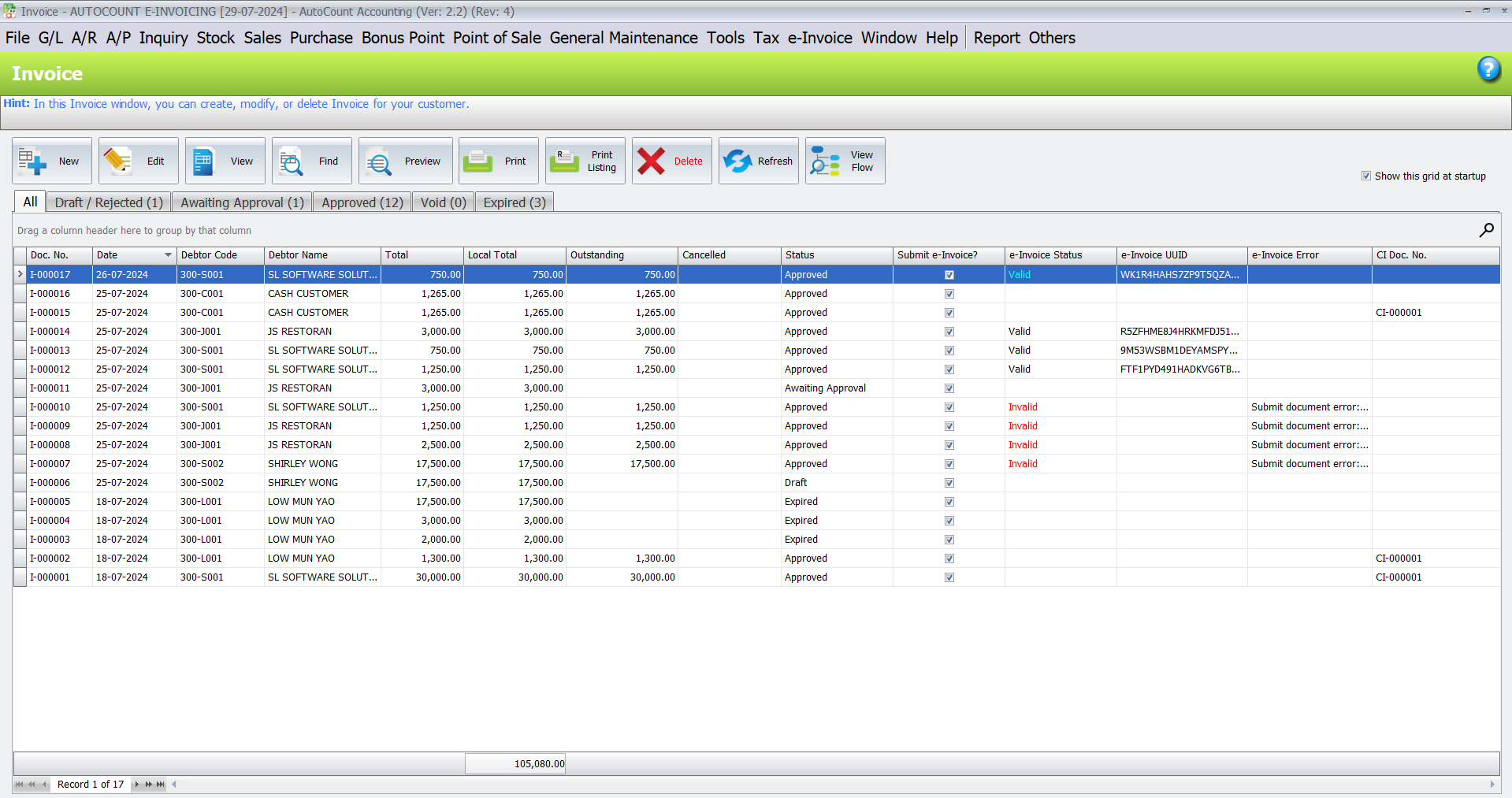

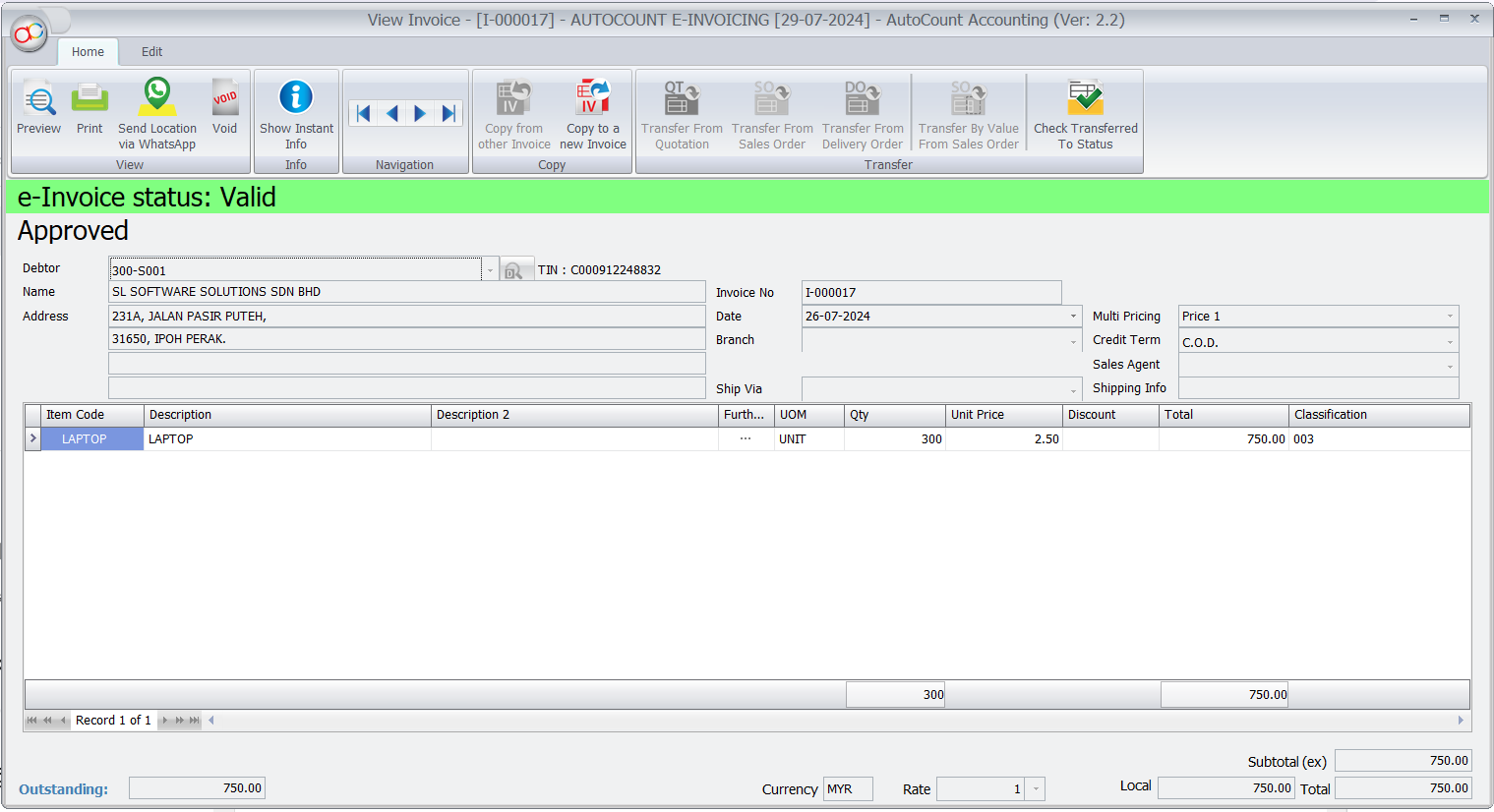

Standard E-Invoice Functions

- New Approval Process

- Filter By Approval Status (tabs to filter by status)

- Show Document Status

- Document Status Change Log

- Support Batch Approval With Multi-Select

- E-Invoice Fields: Status, Error, UUID etc.

- Allow Support Direct Approve Draft Invoice

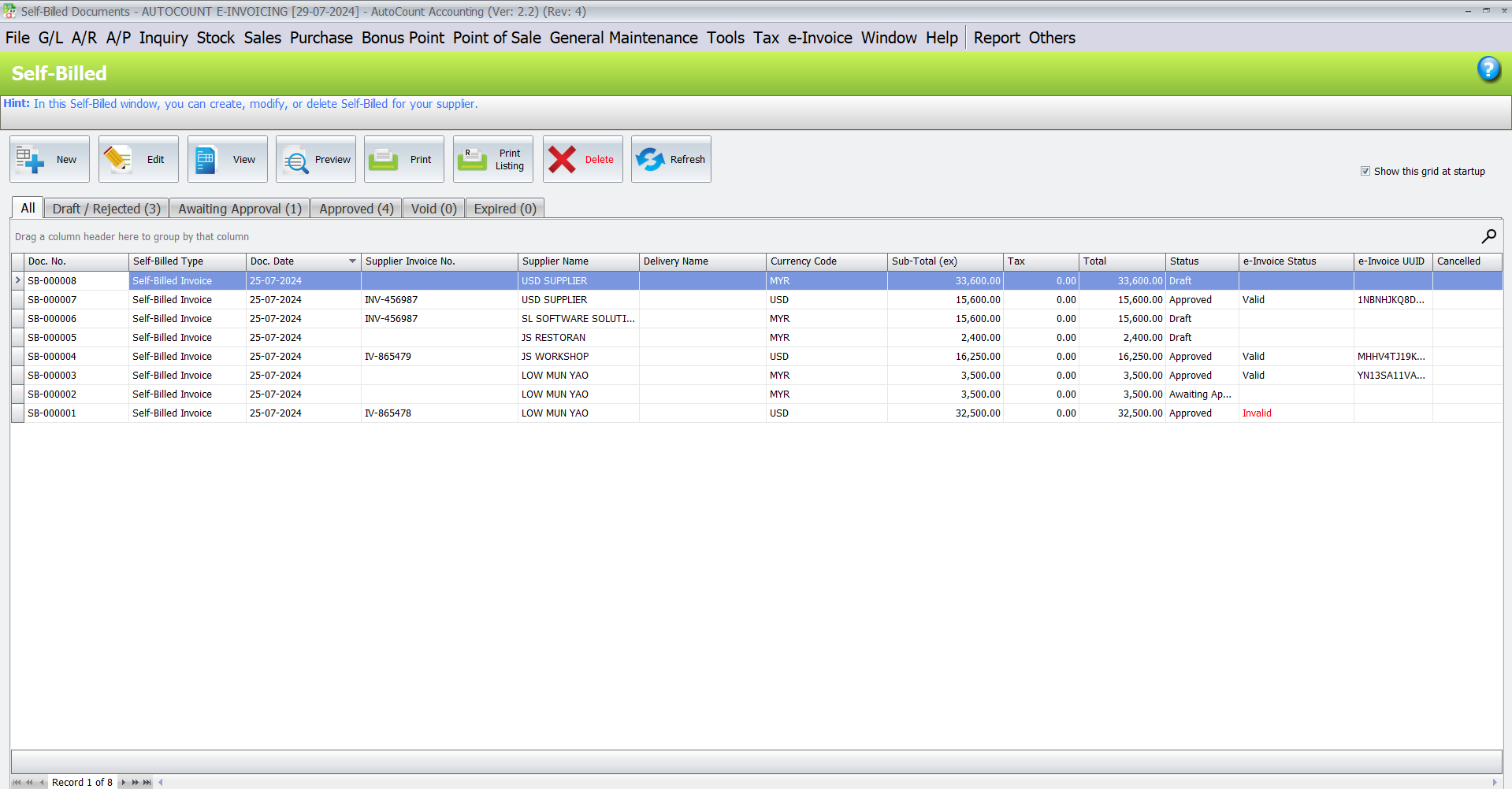

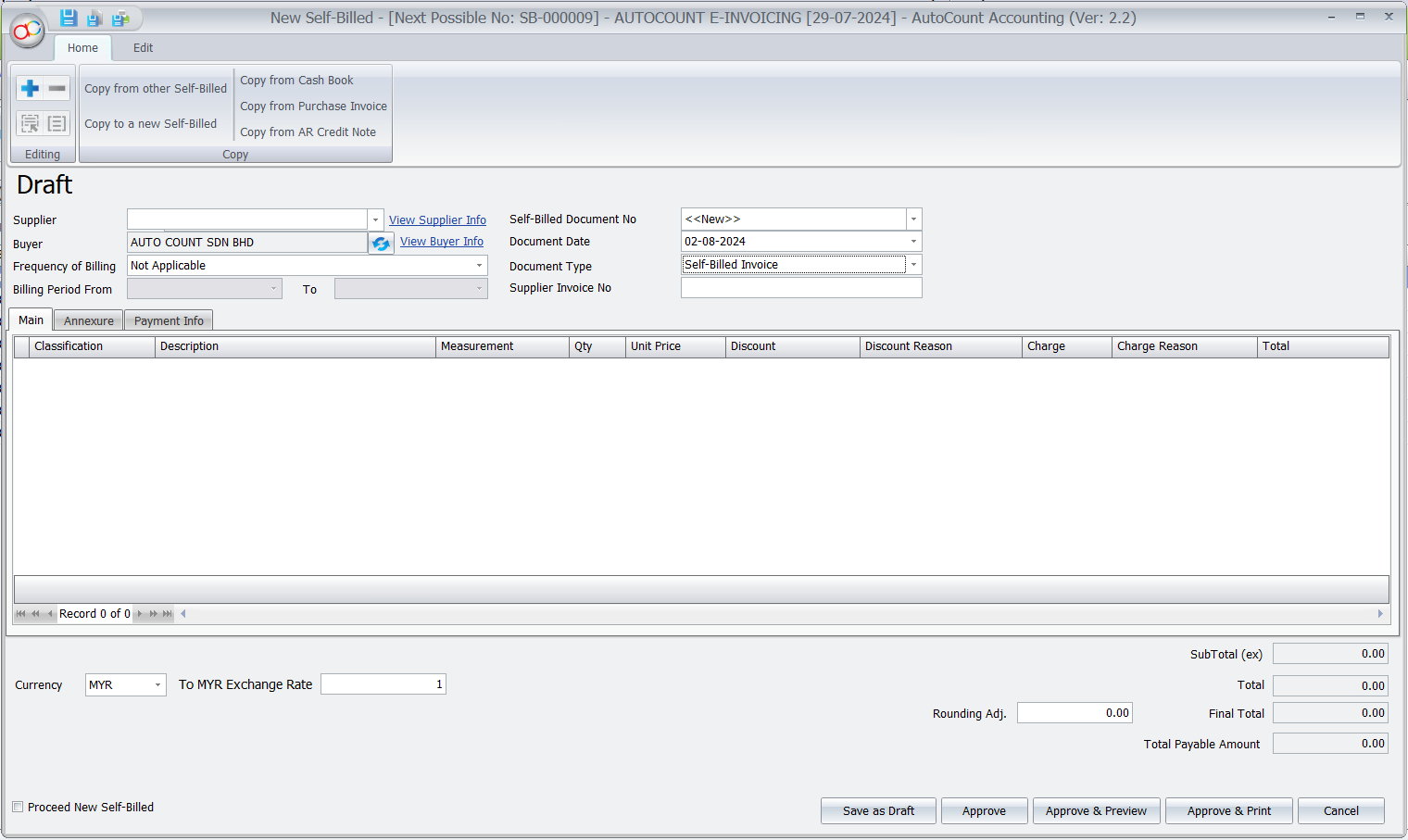

Self-Billed Invoice Functions

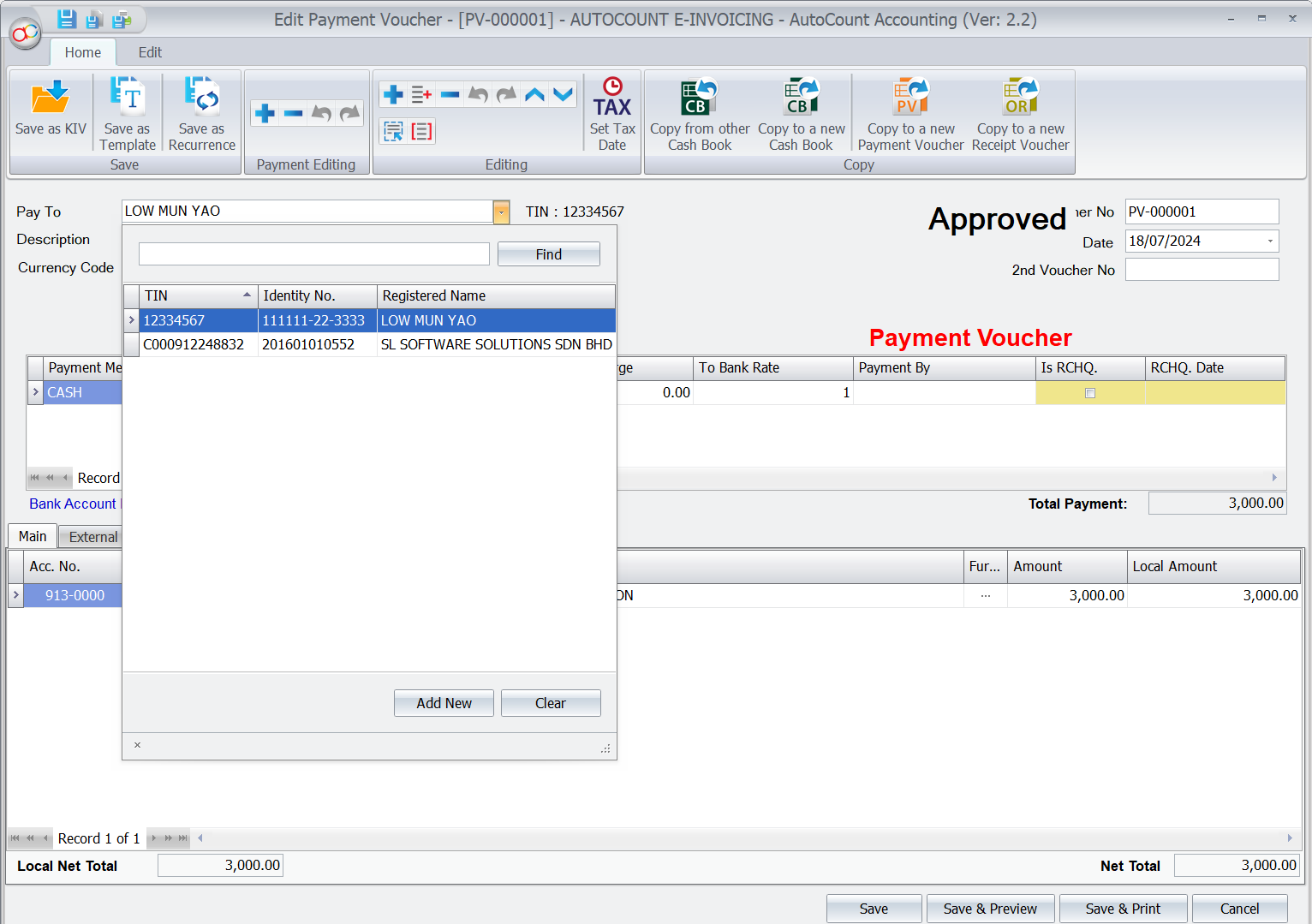

AutoCount supports self-bill invoices by allowing users to copy details from Cash Book (PV) or Purchase Invoices, reducing the risk of duplicate submissions.Self-Billed Invoice Functions

- New Self-Billed Invoice

- Support Approval Process

- TIN / Buyer Information Maintenance

- Lookup for Tax Entity on Cash Book Entry

Industry Specific Controls

AutoCount includes specific controls for different industries:

a) Mandatory Standard E-Invoice for Construction Industry

Consolidate e-invoices are not allowed, ensuring compliance with industry regulations.

b) Control for Mandated E-Invoice Industries

For sectors like automobile, luxury goods, and aviation, AutoCount enforces the issuance of standard e-invoices.

c) Export Business Support

AutoCount supports businesses involved in export by allowing the inclusion of ANNEXURE details in e-invoices. This ensures that e-invoices sent to foreign suppliers meet LHDN requirements for verification.

Conclusion

AutoCount’s e-invoicing solution, especially, led by its innovative AutoCount E-Invoicing Portal (AIP), positions it as the best choice for businesses in Malaysia navigating the new e-invoicing landscape. With features such as queue management, powerful onboarding functions, handling of consolidate e-invoice requests, and advanced business-specific controls, AutoCount ensures compliance, efficiency, and ease of use. Moreover, its first-mover advantage and proven experience in cloud solutions further cement its status as the leading e-invoice solution in Malaysia.

By choosing AutoCount, businesses can seamlessly transition to e-invoicing. Consequently, they can ensure they stay ahead in an evolving regulatory environment.

Simplify Accounting & Tax Compliance with AutoCount

Experience the most trusted accounting software in Malaysia. Automate your daily posting, ensure 100% SST compliance, and generate real-time financial reports with AutoCount Accounting.