Essential Guide to EPF, SOCSO, EIS, and HRD Contributions in Malaysia [2025 Update]

Stay compliant with Malaysia’s statutory salary deductions, including EPF, SOCSO, EIS, and HRD Fund contributions. This guide helps businesses navigate the 2025 changes, ensuring accurate contributions and avoiding penalties. Understand the rates, eligibility, and benefits to secure your employees’ future well-being and maintain smooth payroll operations.

Introduction

In Malaysia, statutory salary deductions are an essential part of employment compliance, safeguarding workers’ rights and future well-being. Understanding these mandatory contributions helps employers remain compliant and allows employees to know where their money is going. This comprehensive guide covers all major deductions effective in 2025, including EPF, SOCSO, EIS, and HRD levy, complete with rates, eligibility, benefits, and penalties for non-compliance.

What is EPF and How It Works

The Employees Provident Fund (EPF) is a mandatory retirement savings plan for employees in Malaysia. Both the employer and employee contribute a portion of the salary to the EPF fund. The employer contributes a percentage based on the employee’s salary, while employees contribute a fixed percentage.

Contribution Rates (2025)

The contribution rate for employers is typically around 13% for employees earning below RM5,000, while employees contribute 11% of their salary.

Purpose

EPF serves as a retirement savings account for employees, ensuring they have financial security after retirement.

What is SOCSO and Its Importance

The Social Security Organization (SOCSO) provides social security protection to employees in Malaysia, covering accidents, death, and disability benefits. All employers are required to register their employees with SOCSO and make contributions.

Contribution Rates (2025)

Employers must contribute 1.75% for employees earning under RM3,000, while employees contribute 0.5%.

Benefits

SOCSO covers accident benefits, disability benefits, and death benefits, ensuring that employees are protected in case of work-related injuries or illnesses.

Understanding EIS (Employment Insurance Scheme)

The Employment Insurance Scheme (EIS) provides protection for employees who lose their jobs. Contributions to EIS are mandatory for all employees and are designed to provide a financial cushion during periods of unemployment.

Contribution Rates (2025)

Employers and employees contribute 0.2% of the employee’s monthly salary towards the EIS fund.

Coverage

EIS offers financial assistance and employment services for employees who are unemployed due to termination, retrenchment, or layoff.

HRD Fund Contributions

The Human Resources Development Fund (HRDF) is a fund established to develop human capital through training programs. HRD contributions are mandatory for certain sectors and are meant to help companies upskill their employees.

Contribution Requirements

HRD contributions are calculated based on a percentage of the monthly salary for certain industries. Employers are required to contribute 1% of their employees’ salaries if they fall under the specified industry sectors.

Purpose

The HRDF is aimed at improving the skills of employees and enhancing their employability, especially in fast-evolving industries.

2025 Compliance Requirements

With the coming changes in 2025, businesses need to ensure they are adhering to updated EPF, SOCSO, EIS, and HRD Fund contribution rates and compliance requirements. This includes:

- Ensuring the correct contribution rates are applied based on employee salaries and classifications.

- Updating payroll systems to account for changes in tax rates, contribution thresholds, and regulatory changes.

- Maintaining accurate records for auditing purposes and ensuring all payments are made on time to avoid penalties.

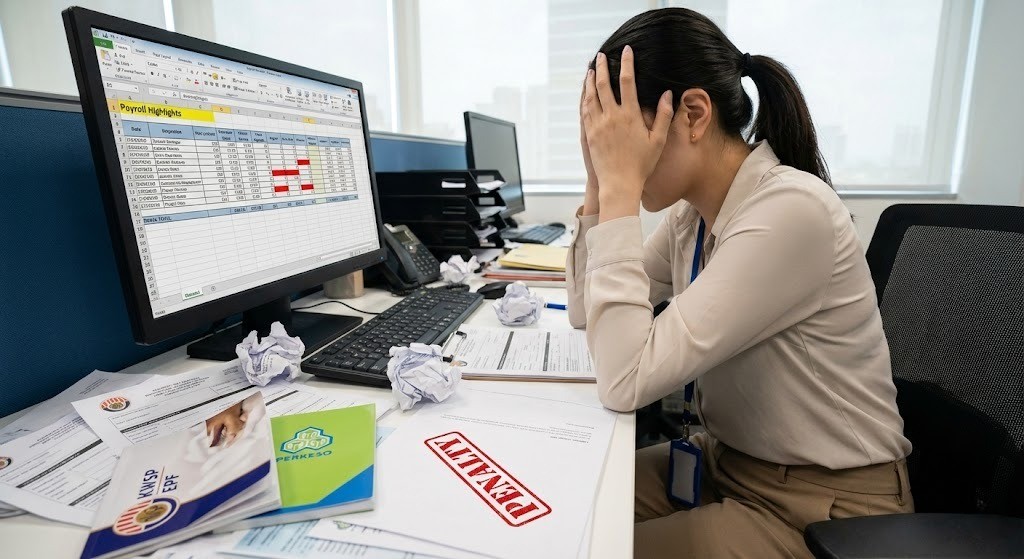

Common Payroll Mistakes to Avoid

Many businesses make payroll errors that can result in penalties, legal issues, and employee dissatisfaction. Here are some common payroll mistakes to avoid:

- Incorrect contribution amounts for EPF, SOCSO, EIS, or HRD due to outdated rates.

- Failure to file reports or pay contributions on time, leading to fines and interest charges.

- Misclassification of employees or failure to update salary details, resulting in incorrect deductions.

- Not keeping accurate employee records for audits and future reference.

Optimize Your Financial Strategy with AutoCount

Learn how understanding the difference can streamline your operations. Get started with AutoCount Accounting