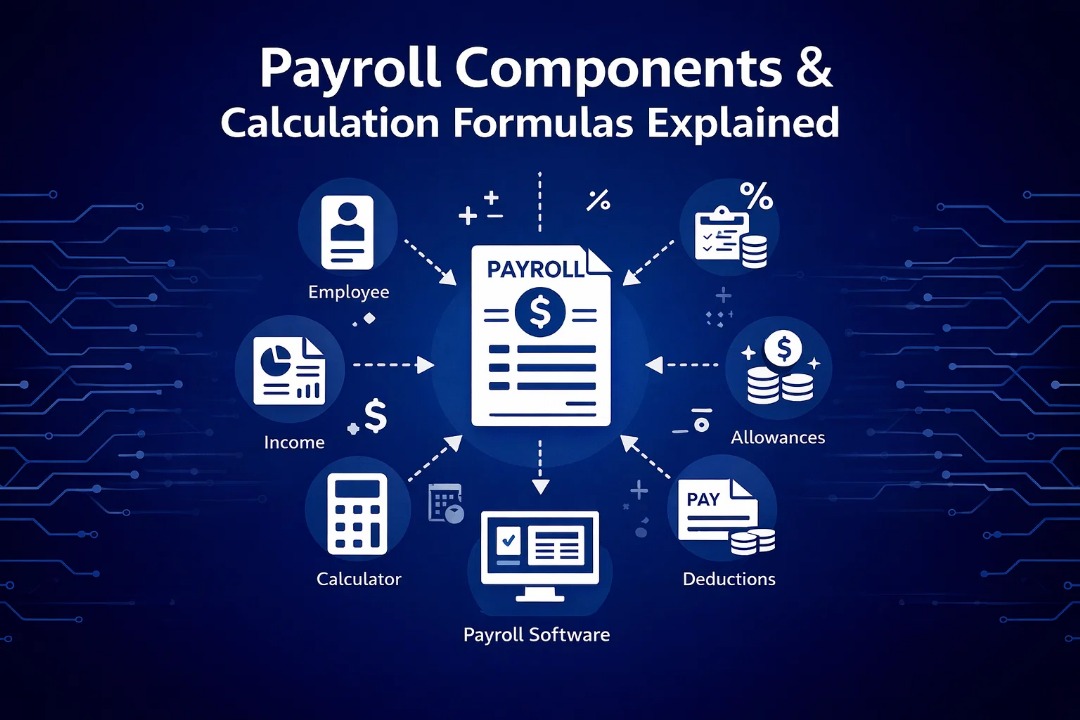

Payroll Components & Calculation Formulas Explained

Streamline payroll management with AutoCount Cloud Payroll. Accurately calculate salaries, deductions, and allowances while staying compliant with Malaysia’s latest payroll regulations. Let AutoCount handle the complexities, so you can focus on growing your business.

Introduction

Payroll management isn’t just about paying salaries — it’s about calculating the right components, applying the correct deductions, and staying compliant with Malaysian law. This guide covers the most commonly used payroll elements and shows you how to calculate them accurately using AutoCount Cloud Payroll.

Most Common Payroll Components in Malaysia

Here’s a breakdown of key elements you’ll frequently see in employee payslips — and whether they are subject to EPF, SOCSO, EIS, Tax, or HRDF.

Commonly Used Payroll Elements:

| Payroll item | EPF | SOCSO / EIS | Taxable | HRDF |

|---|---|---|---|---|

| Basic Salary | ✅ | ✅ | ✅ | ✅ |

| Bonus | ✅ | ❌ | ✅ | ❌ |

| Commission | ✅ | ✅ | ✅ | ❌ |

| Director Fees (receive by yearly) | ❌ | ❌ | ✅ | ❌ |

| Director Fees (receive by monthly) | ❌ | ❌ | ✅ | ❌ |

| Paid Leave | ✅ | ✅ | ✅ | ✅ |

| Unpaid Leave | ❌ | ✅ | ✅ | ✅ |

| Absent | ✅ | ✅ | ✅ | ✅ |

| Overtime | ❌ | ✅ | ✅ | ❌ |

| Childcare Allowance* | ✅ | ❌ | ✅ | ✅ |

| Education Allowance* | ✅ | ❌ | ✅ | ✅ |

| Housing Allowance* | ✅ | ❌ | ✅ | ✅ |

| Parking Allowance* | ✅ | ❌ | ❌ | ✅ |

| Petrol/Travelling Allowance* | P: YES T: NO |

P: YES T: NO |

✅ | ❌ |

| BroadBand / Telephone / Mobile Plans* | ✅ | ❌ | ❌ | ✅ |

| Attendance Allowance** | ✅ | ✅ | ✅ | ❌ |

| Shift Allowance** | ✅ | ✅ | ✅ | ❌ |

| Meal Allowance** | ✅ | ❌ | ❌ | ❌ |

| Payment of Arrears | ✅ | ✅ | ✅ | ✅ |

| Claim (Reimbursement) | ❌ | ❌ | ❌ | ❌ |

| Advanced Deduction | ❌ | ❌ | ❌ | ❌ |

| Loan Deduction | ❌ | ❌ | ❌ | ❌ |

Default Statutory Selections for Employees

AutoCount simplifies statutory configuration by applying default logic based on employee type and age.

EPF(KWSP)

Default: 11% employee + 12% or 13% employer

Above 60: 0% employee + 4% employer

Foreigners: Optional, not compulsory

SOCSO(PERKESO)

Category 1: Malaysians under 60 (Injury + Invalidity)

Category 2: Malaysians 60+, and non-Malaysians (Injury only)

EIS

Applies to Malaysians aged 18–60 only.

Income Tax (LHDN)

Resident: Malaysian or foreigner who stays 182+ days.

Non-resident: 30% flat tax

Special Cases: Return Expert Program (REP), Knowledge Workers (Iskandar), C-Suite (15% flat tax under PENJANA)

HRDF

Malaysians only — employer pays 1% of monthly wages.

Small Employers: May qualify for 0.5% contribution class.

Malaysia’s Minimum Wage (2025)

As of February 2025, the minimum wage in Malaysia is:

Note

This is enforced under the Employment Act 1955 and applies to all full-time employees.

Payroll Calculation Formula(s)

As of February 2025, the minimum wage in Malaysia is:

- Basic Salary (Prorated)

(Monthly Salary ÷ Working Days in Month) × Days Worked

- Unpaid Leave / Absence>⛔

(Monthly Salary ÷ Working Days in Month) × Days Absent

- Paid Leave

(Monthly Salary ÷ 26) × Paid Leave Days

- Overtime Calculation

(Monthly Salary ÷ 26 ÷ 7.5 or 8) × Overtime Rate × Hours Worked

Overtime Rates:

| Situation | Rate |

|---|---|

| Normal Working Day | 1.5x |

| Rest Day (up to half of normal hours) | 0.5x |

| Rest Day (more than half, up to normal hours) | 1.0x |

| Rest Day (exceeds normal hour) | 2.0x |

| Public Holiday (normal hours) | 2.0x |

| Public Holiday (exceed normal hours) | 3.0x |

Note

45 hours/week is now the legal maximum. Anything above that counts toward OT.

Why Use AutoCount for Payroll Calculations?

- Pre-loaded formulas based on Employment Act 1955

- Pre-loaded formulas based on Employment Act 1955

- Calculates overtime, leave, and allowances with one click

- Statutory contributions auto-applied

Conclusion

Understanding how payroll is calculated is crucial to run a compliant and smooth business. AutoCount takes the guesswork out of payroll — so you can focus on growing your team.

Want to simplify your business finances?

AutoCount Payroll automates wage classification, statutory deductions, and compliance with ease, saving you time and reducing errors.