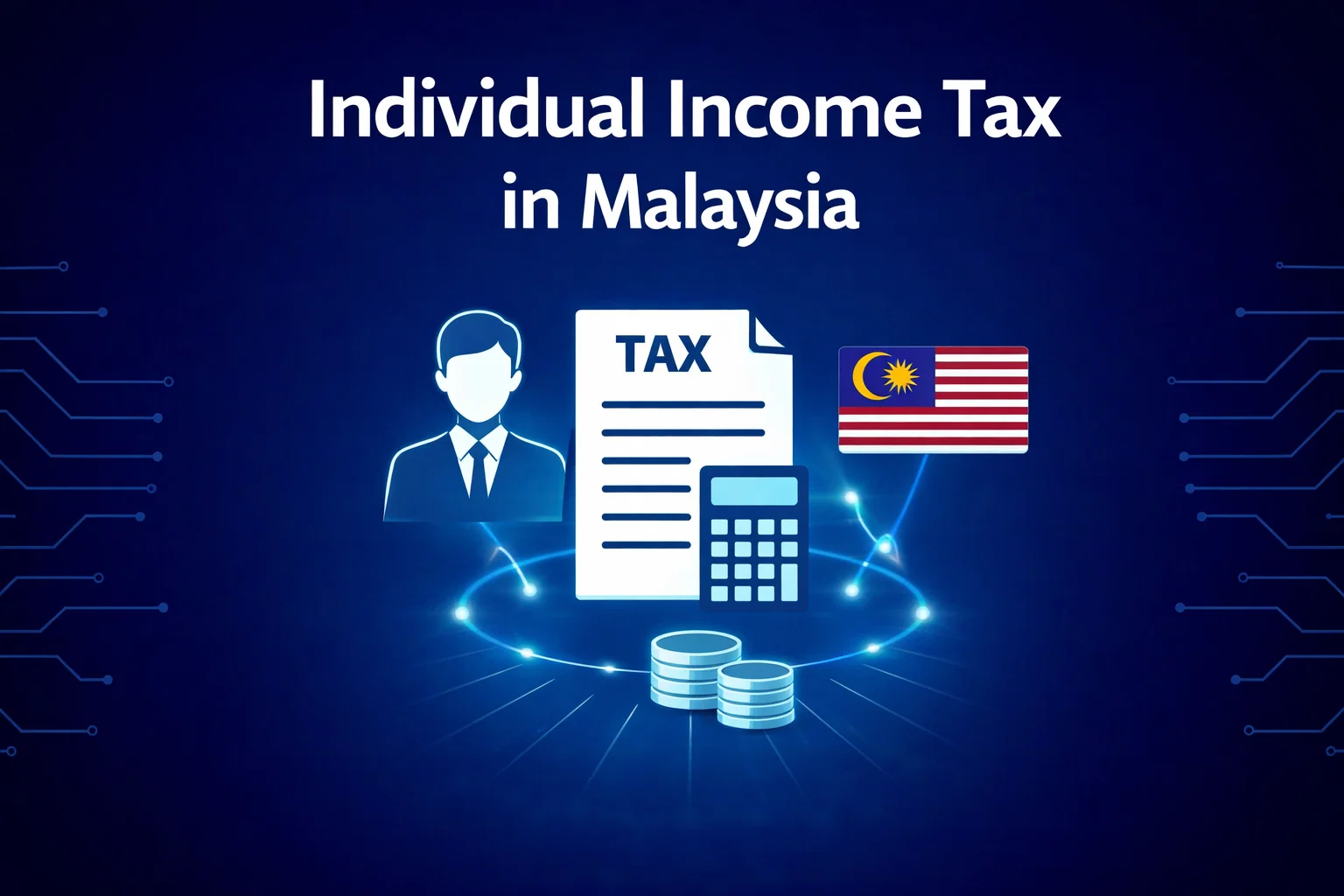

Individual Income Tax in Malaysia

Complete information on Malaysia’s progressive tax system, rates, exemptions, deductions, and how AutoCount Payroll simplifies tax compliance for businesses and individuals.

What Is Individual Income Tax in Malaysia?

Individual income tax in Malaysia is a progressive tax system imposed on earnings made by individuals within the country. It applies to various types of income, such as salaries, bonuses, commissions, rental income, and freelance earnings. True to the principles of progressive taxation, higher income levels are taxed at higher rates to ensure fairness across different earning brackets.

Malaysia’s system not only caters to local residents but also to foreigners working or residing within its borders. The Inland Revenue Board of Malaysia (LHDN) oversees the collection and enforcement of income tax, ensuring that all eligible taxpayers comply with the rules and benefit from applicable reliefs and rebates.

For a more streamlined payroll tax experience, check out this step-by-step guide for PCB calculations in Malaysia.

Malaysian Income Tax Rates for 2025

In Malaysia, individual income tax rates are progressive. This means the rate increases as your income rises. Here is a breakdown of the tax brackets for 2025:

| INCOME RANGE (RM) | TAX RATE |

|---|---|

| Up to RM5,000 | 0% |

| RM5,001 to RM20,000 | 1% |

| RM20,001 to RM35,000 | 3% |

| RM35,001 to RM50,000 | 8% |

| RM50,001 to RM70,000 | 14% |

| RM70,001 to RM100,000 | 21% |

| RM100,001 to RM250,000 | 24% |

| RM250,001 to RM400,000 | 24.5% |

| Above RM400,000 | 25% |

These progressive rates ensure that individuals are taxed based on their income level. Always ensure you are paying the correct amount by following the relevant tax rates.

Income Tax Exemptions

In Malaysia, various income tax exemptions and reliefs are available to reduce the taxable income. Common exemptions include:

- Tax Relief for Children

Parents can claim relief for children under 18 or students in full-time education.

- Life Insurance Premiums

You can claim deductions for premiums paid on life insurance policies.

- Medical Expenses

Tax relief is available for medical expenses incurred for self, spouse, and children.

- Retirement Savings (EPF)

Contributions to the Employees Provident Fund (EPF) can be claimed as a tax deduction.

Make sure to check your eligibility for any tax exemptions that might apply to your situation in 2025. These exemptions can help reduce your tax burden significantly.

How to File Income Tax in Malaysia

Filing income tax in Malaysia is a straightforward process, but it’s essential to meet the deadline and follow the proper steps:

- Gather Documentation

Collect documents such as salary slips, EPF contribution records, and medical bills.

- Submit and Pay

Submit your form through the e-Filing system before the deadline and make any necessary payments.

It is advisable to file taxes early and keep all records organized for future reference. Failing to submit on time can result in penalties or fines.

Tax Deductions Available

To reduce your taxable income, Malaysia offers various deductions that help taxpayers save on taxes. Some common deductions include:

Childcare Costs

Tax deductions are available for childcare expenses.

Medical Expenses

If you incur medical costs for serious illnesses, you can claim these expenses.

Education Expenses

Deductions for tuition fees and other educational costs for yourself or your dependents.

Using these tax deductions appropriately can help you minimize your tax liability. Consult with a tax expert to ensure you’re claiming all available deductions for 2025.

To ensure smooth invoicing and financial documentation, consider using AutoCount’s Top E-Invoice Software in Malaysia, which integrates seamlessly with your accounting processes.

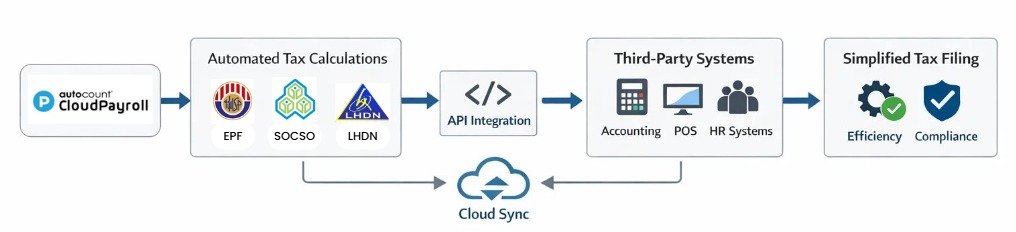

How AutoCount Can Help with Tax Filing

AutoCount Payroll simplifies income tax filing in Malaysia by automating the calculation of EPF, SOCSO, and other deductions. With real-time updates to tax rates and easy e-Filing options, AutoCount ensures that your business remains compliant with income tax laws.

Automated tax calculations based on employee salary and deductions.

Integrated EPF, SOCSO, and PCB management for accurate reporting.

Streamlined e-Filing process to submit taxes on time with confidence.

Frequently Asked Questions

Who needs to pay income tax in Malaysia?

Anyone who earns income and is a resident in Malaysia for at least 183 days in a year, and whose total income exceeds the tax threshold.

When is the tax year in Malaysia?

The tax year is the calendar year, from January 1 to December 31.

What are the income tax rates in Malaysia?

Income tax rates are progressive, ranging from 0% to 28% for residents, depending on income. Non-residents are taxed at a flat 30%.

Need Professional Payroll Management Solutions?

Our certified payroll specialists ensure accurate, compliant, and efficient payroll processing, allowing you to focus on strategic business priorities.