-

AutoCount Accounting Features

-

- Approval Workflow

- Audit Trail

- Auto Save in Draft Folder

- AutoCount Contra Account

- AutoCount License Setting Guide

- Deposit Tracking & Management

- Documents Numbering Format

- Full Transfer and Partial Transfer

- Import Data to AutoCount Accounting Using Excel

- Informative Charts and Analytical Data

- Layout Customization

- Multi Pricing

- Sales and Services Tax

- Schedule Backup

- Search Lookup Edit

- View Documents Flow

- AutoCount Feature Stock Take

- Show Remaining (2) Collapse

-

AutoCount Cloud Accounting

-

AutoCount E-Invoice

-

AutoCount HRMS User Guide

-

AutoCount Modules

-

- Activity Stream

- Advanced Financial Report

- Advanced Item

- Advanced Multi-UOM

- Advanced Quotation Module

- Basic Multi-UOM

- Budget Module

- Consignment

- Filter By Salesman

- FOC Quantity

- Formula

- Item Batch

- Item Package

- Landing Cost

- Multi-Currency

- Multi-Dimensional Analysis

- Multi-Location

- Project Account

- Recurrence

- Remote Credit Control Module

- Stock Assembly

- User Defined Fields (UDF)

- AutoCount SST Hidden Functions

- AutoCount SST Submission - Service Tax

- Show Remaining (9) Collapse

-

AutoCount Plugins

-

Form Template

-

Report Template

-

- Advance Quotation

- Cash Sale

- Consignment

- Consignment Movement

- Credit Note

- Debit Note

- Delivery Order

- FOC Quantity Analysis By Document Report

- Invoice

- Item Package Sales Report

- Monthly Sales Analysis

- Outstanding Sales Order Listing

- Profit And Loss Of Documents

- Quotation

- Sales Agent Contribution Report

- Sales Order

- Top/Bottom Sales Ranking

- Show Remaining (2) Collapse

-

- Available Stock Status Report

- Expired Item Batch Listing

- Inventory Physical Worksheet

- Stock Adjustment

- Stock Aging Report

- Stock Assembly

- Stock Assembly Order

- Stock Balance By Location

- Stock Balance Report

- Stock Card Report

- Stock Disassembly

- Stock Issue

- Stock Item Profit Margin

- Stock Movement Report

- Stock Receive

- Stock Take

- Stock Transfer

- Stock Write Off

- Show Remaining (3) Collapse

AutoCount Module: SST Submission - Service Tax

SST Submission - Service Tax

Before submitting your Sales and Service Tax (SST) return in AutoCount, it’s vital to check for errors and inconsistencies that might lead to incorrect tax reporting or audit queries. The system provides key tools to help you catch common issues — such as unapplied payments, missing tariff/text codes, and B2B exemptions — before processing your SST return.

SST Pre Submission Check Guide

Discover hidden features of AutoCount SST in this demo. Learn how to optimize your workflow with advanced tools and hidden functionalities in AutoCount Accounting for Service Tax submissions.

Core Features

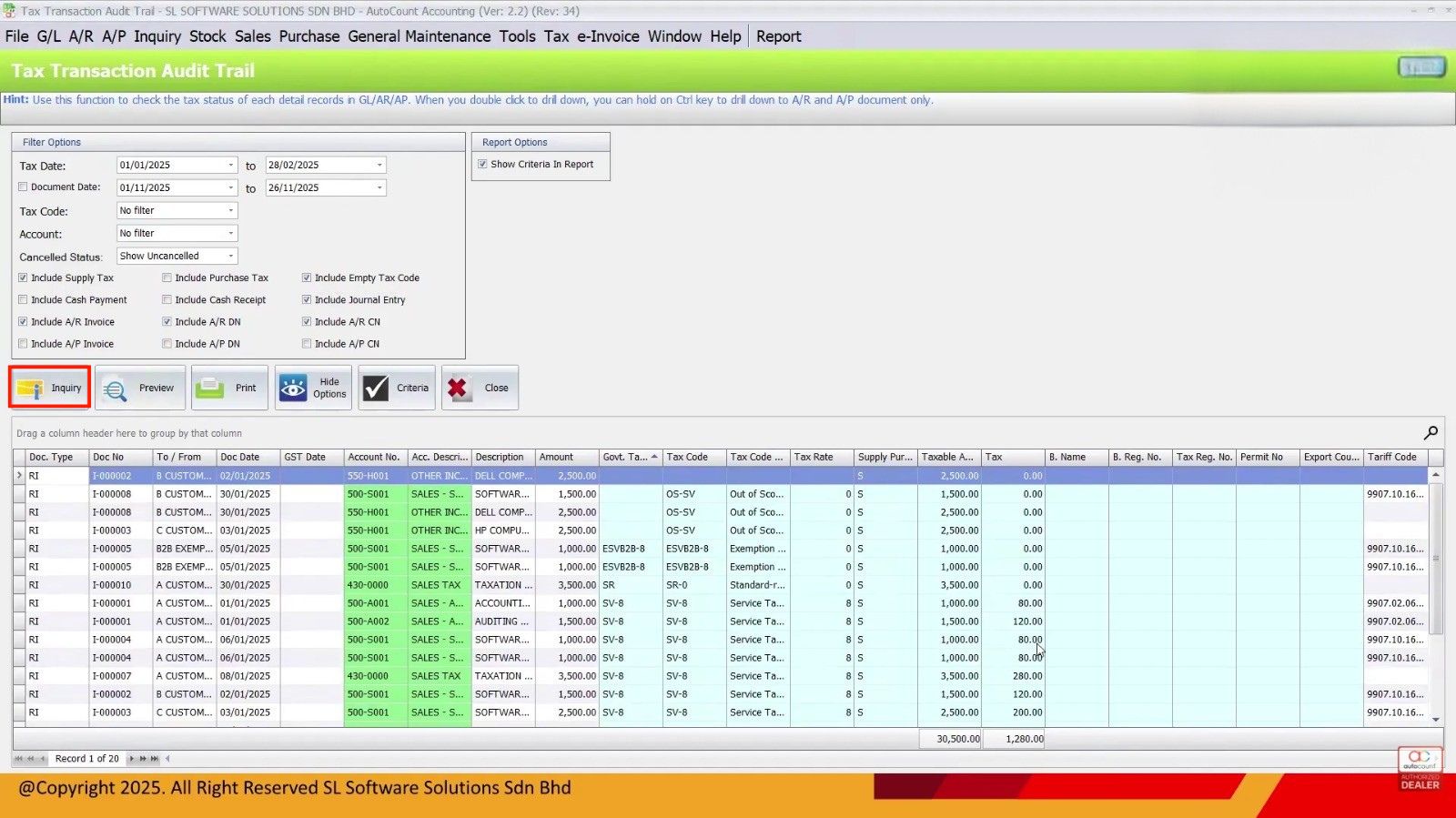

Text Transaction Audit Report

Use this to review all SST‑related transactions before processing. It helps you identify:

- Outstanding official receipts (payments not knocked off submitted invoices).

- Unapplied credit notes (credit notes not applied to invoices).

These must be resolved because SST is payment‑basis — service tax is only due when payment is received.

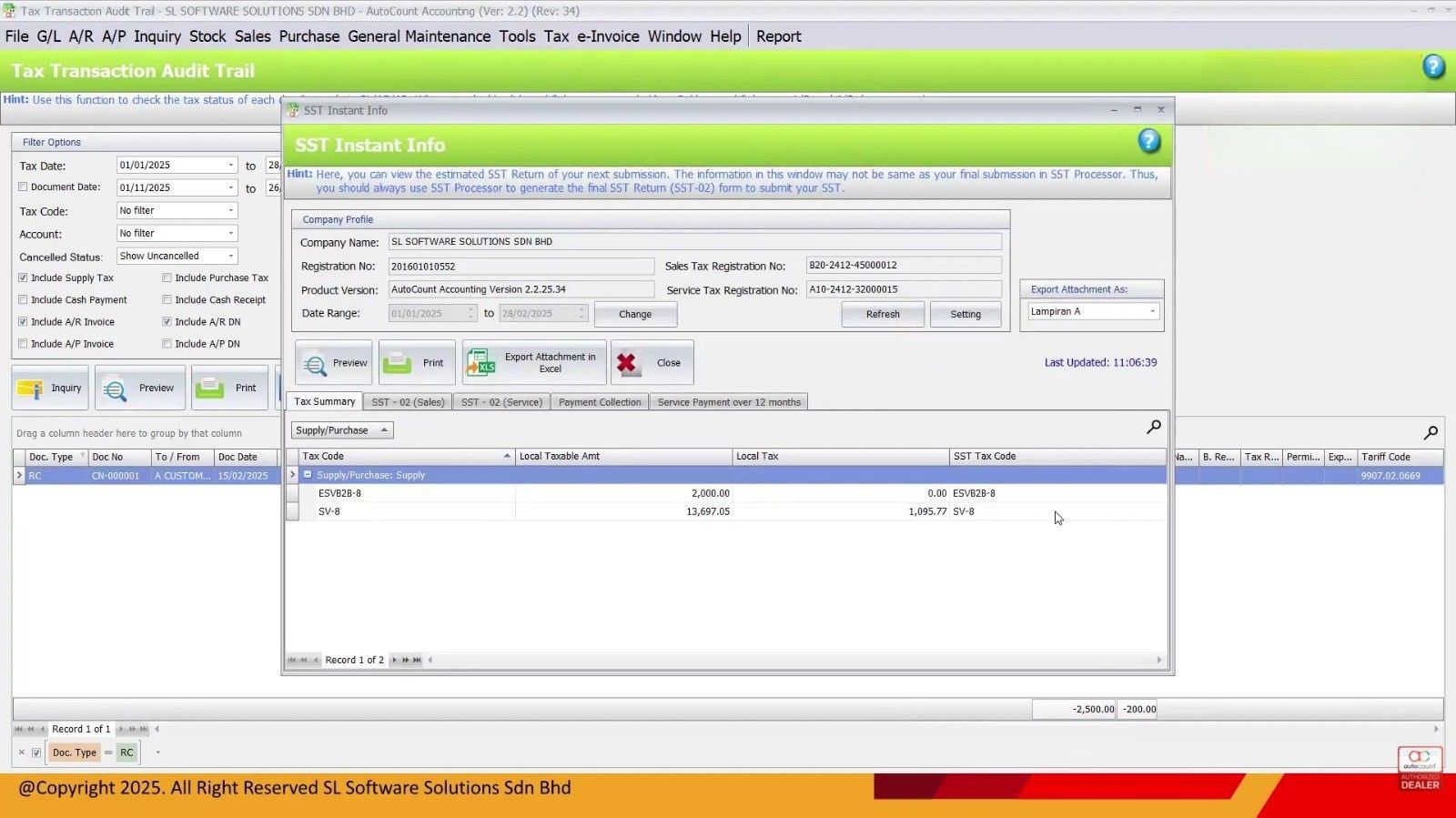

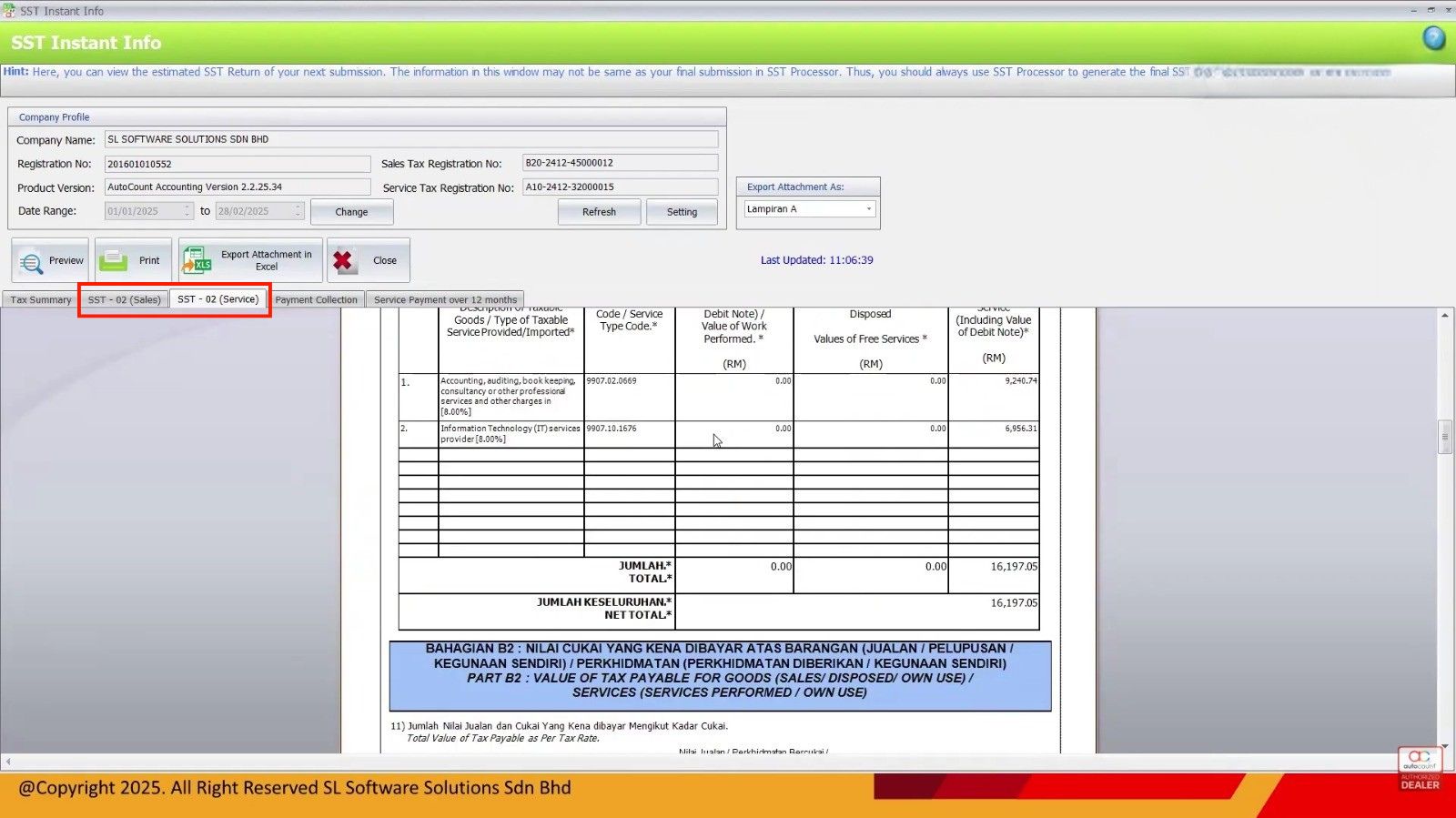

SST Incident Report / SST Insert Info

This report compiles all tax codes, tariff codes and summaries of what’s been captured in your SST period. Use it to find:

Missing text code

Missing tariff code

Transactions that could cause gaps or misclassification in SST reporting

You can edit entries directly from this report to correct missing codes before submitting SST.

Outstanding Service Tax Listing

This lets you identify:

- Service tax amounts that are not yet collected by your cut‑off date.

- Service tax payments outstanding beyond 12 months (which must be included in SST).

This is important for ensuring you capture all taxable payments in your submission period.

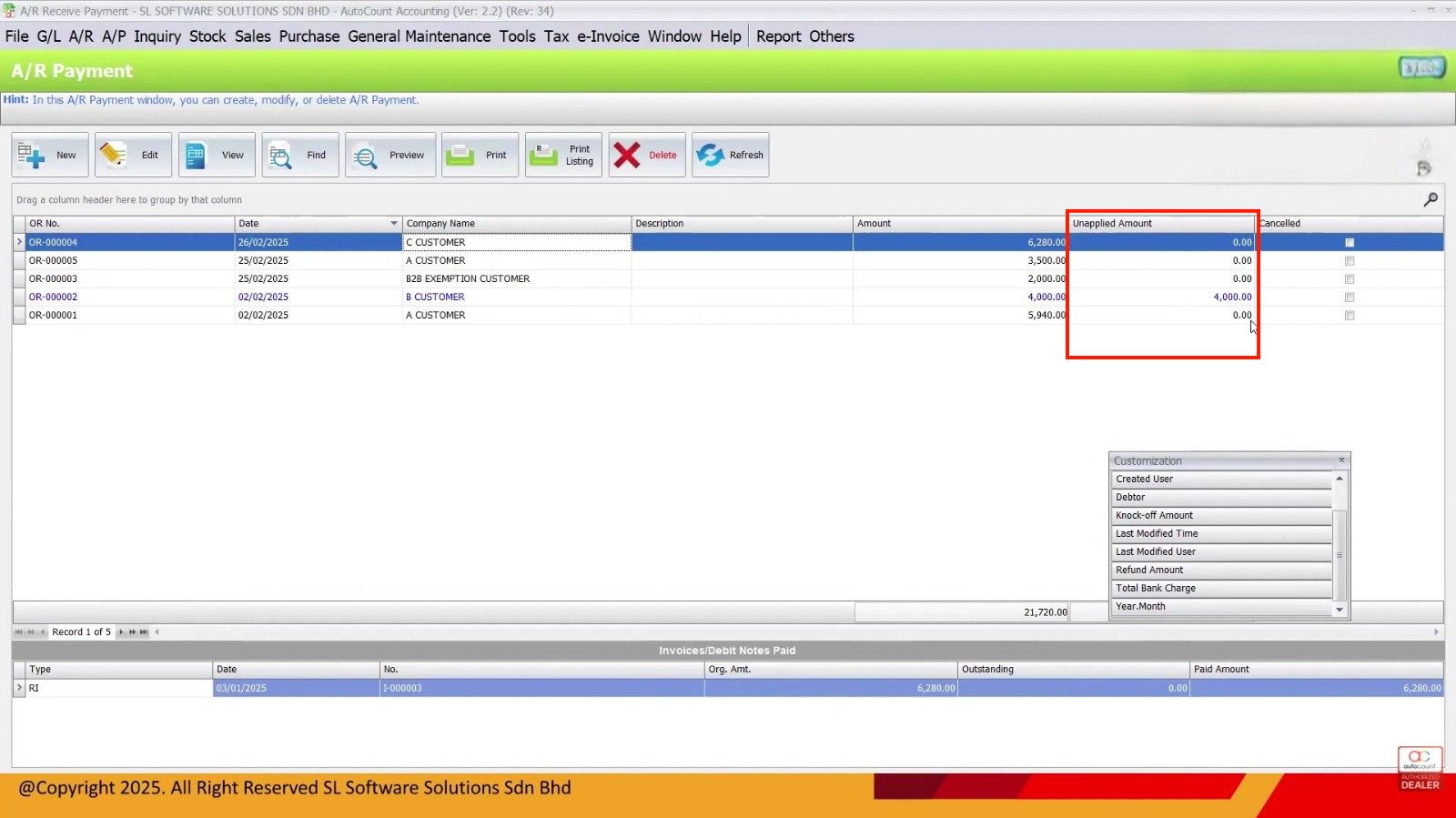

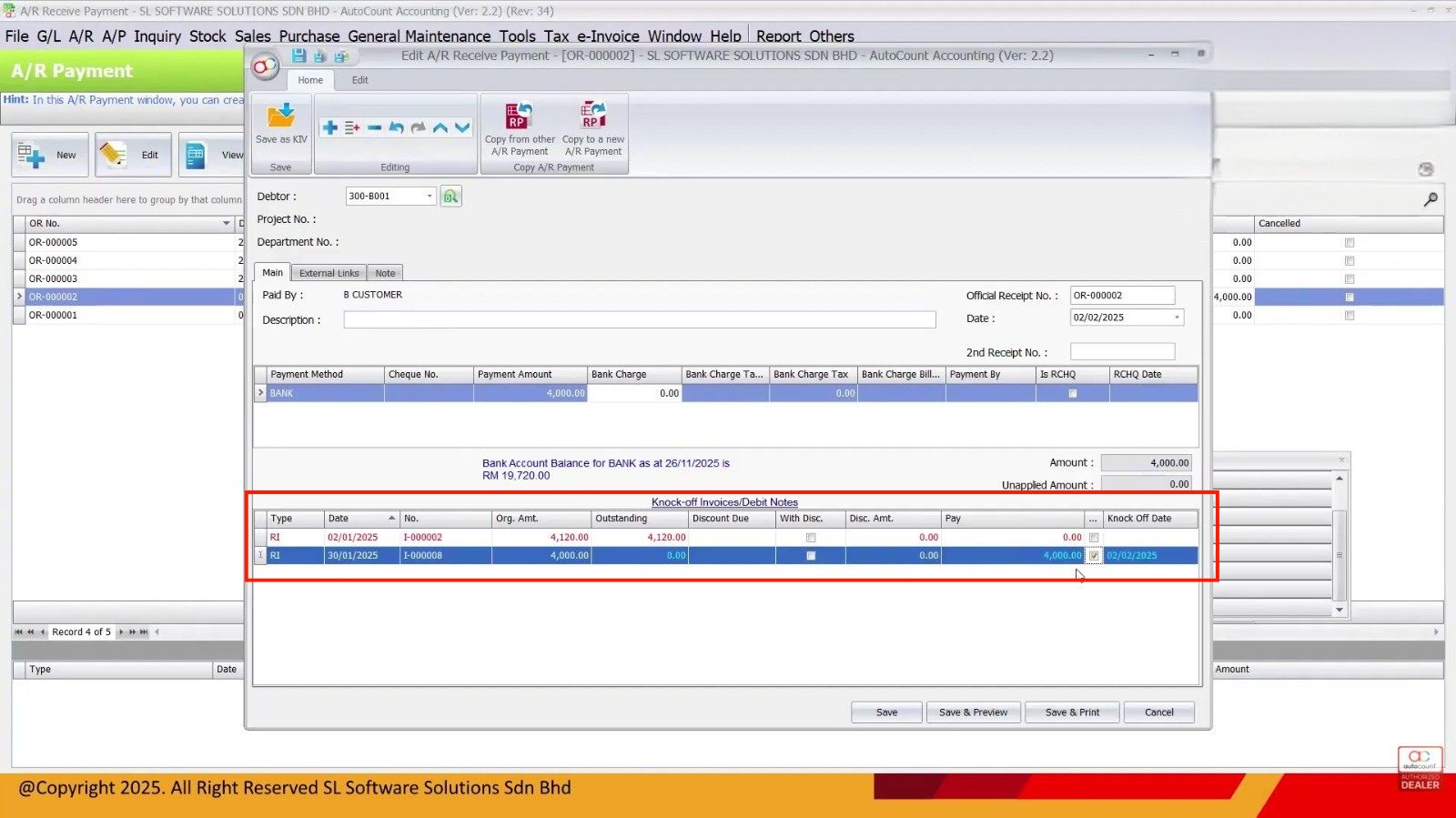

Resolve Outstanding Official Receipts

What to Do:

- Look for unapplied amounts — payments that are not knocked off any invoice.

- Check for payments that aren’t cancelled — these need to be knocked off against the correct invoices so SST is calculated on the correct base.

- Use the Cancel and Unapplied Amount columns to find them.

This ensures all payments that trigger SST are reflected properly before processing.

Resolve Unapplied Credit Notes

What to Do:

- Identify credit notes showing unapplied amounts.

- Apply them to the correct invoices so they don’t distort the SST totals.

Leaving them unapplied could cause under‑reporting of tax or mismatch in your SST summary.

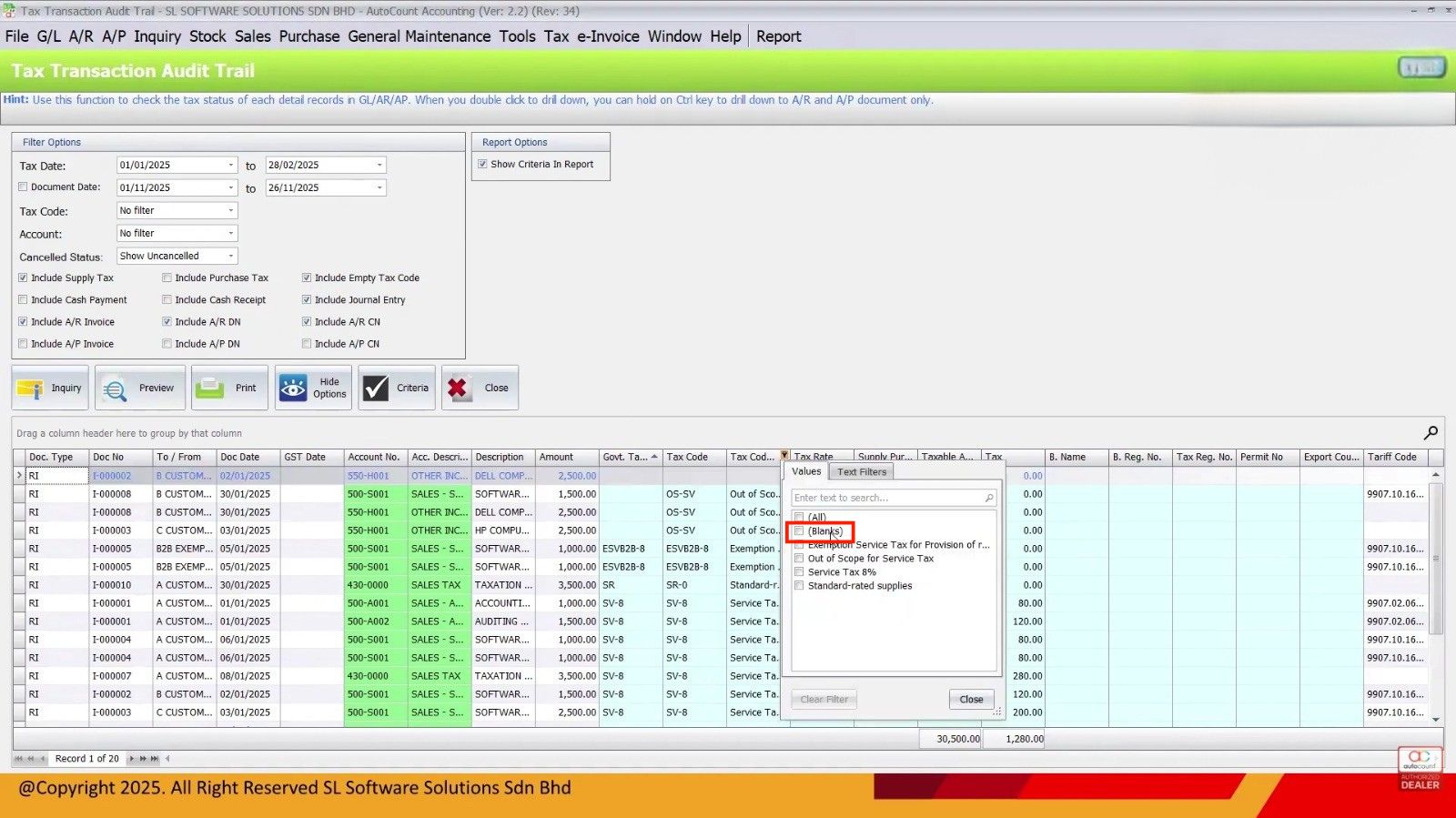

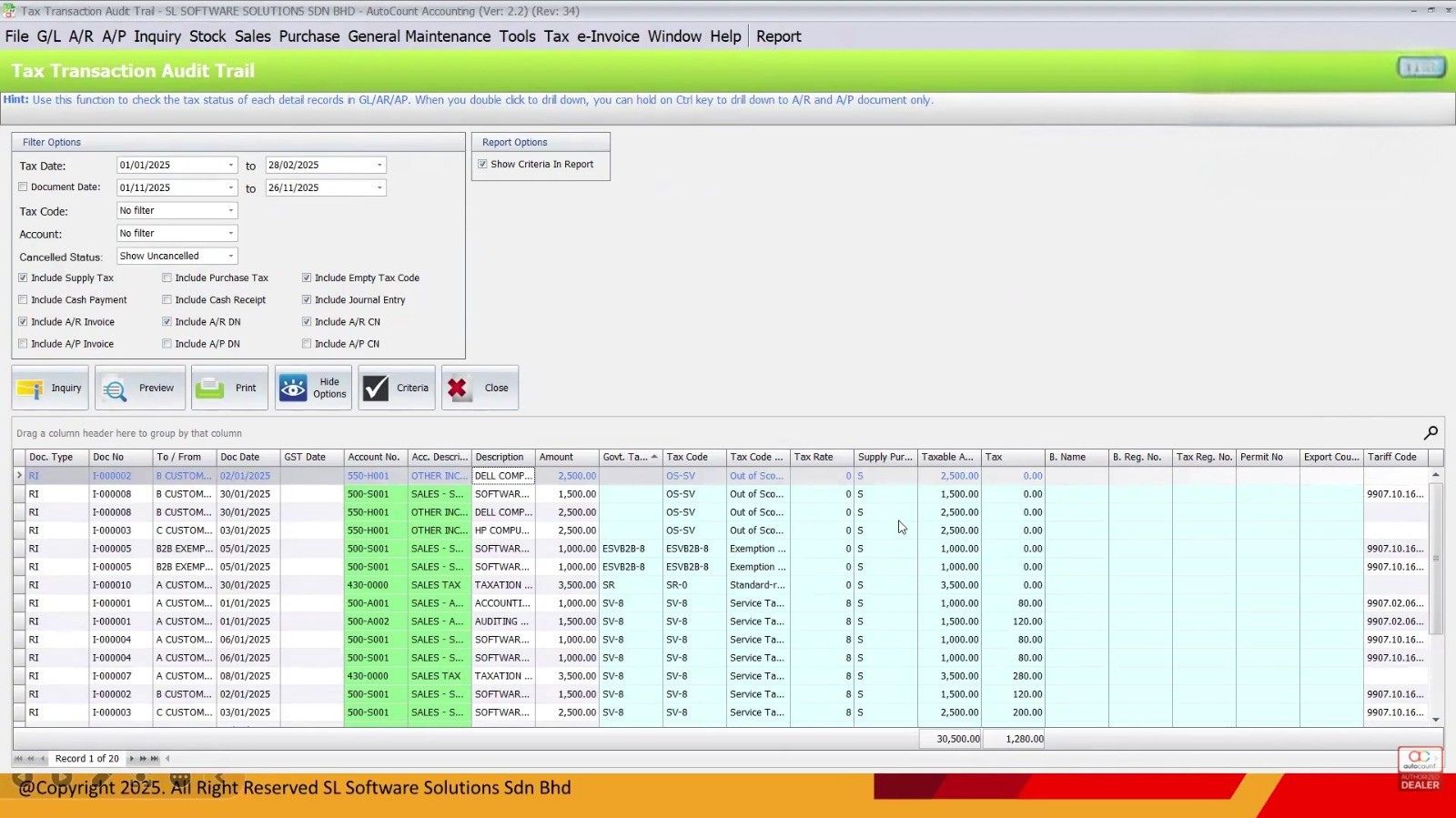

Run the Text Transaction Audit Report

What to Check:

- Empty text codes (text code field blank) — missing SST tax definitions lead to errors in SST totals.

- Empty tariff codes — tariff codes determine the tax calculation and must be populated where applicable.

- Use Inquiry to list blank text codes and empty tariff code cases, then edit them back to valid codes manually or via edit functions where available.

Validate Tax Dates & Transaction Scope

What to Check:

- Input the correct tax date range for your SST period — typically this is the period for which you’re submitting (e.g., 1 Jan to 28 Feb).

- Remember SST is payment basis, so the report focuses on payment dates, not invoice dates.

Check B2B Extension Eligibility

What to Do:

- For service transactions between registered businesses (B2B extension), verify that both parties are SST‑registered for the same category.

- Confirm via government SST status websites or internal records that your customer qualifies for “extension” (exemption).

Incorrect B2B assumptions can cause tax to be charged incorrectly.

Review SST Insert Info / Summary Screen

What to Check:

- The SST insert info screen shows all SST codes and totals used in the period.

- Ensure all tax codes are mapped correctly and that the tariff code list does not show “Others” without validation.

- Compare totals to expected SST values from your collection reports.

Export Supporting Listings

What to Do:

- After checking reports, export to Excel key listings like payment collection and tax summary for internal records or audit trails.

- These can be attached when submitting SST forms to the tax authorities or used for reconciliations.

Why These Checks Matter

Avoid Under or Over Reporting Tax

Ensures actual payments and credits are correctly factored.

Minimize Audit Risk

Proper checks reduce the chance of missing tax due to unapplied payments or missing codes.

Compliance Assurance

Aligns your SST submission with payment basis rules and reporting requirements.

Documented Review Trail

Exported reports assist during tax audits or internal reviews.

Conclusion

The AutoCount SST Pre‑Submission Check workflow helps you catch the most common tax errors — from unapplied receipts to missing tax codes — before you hit Process SST. By following the structured checks above and using AutoCount’s built‑in reporting tools, you can submit SST returns with confidence and avoid unnecessary compliance issues.

Frequently Asked Questions

What is the difference between unapplied payment and unapplied amount in SST?

Unapplied payment means a payment received (or a credit note issued) that hasn’t been matched (knocked off) to an invoice. This results in an unapplied amount which must be applied before SST processing so that the tax is calculated on the correct payment base.

Why does AutoCount focus on payment basis for SST?

Service tax under SST is recognized when payment is received, not when the invoice is issued. Therefore, SST reports and processor use payment dates for accuracy.

What happens if I process SST without checking unapplied items?

The SST processor may produce incorrect totals because it only considers applied payments within the period. Unmatched receipts or credit notes can distort the calculation and lead to compliance issues.

Do I need to submit Excel reports to custom authorities?

Yes — exports like Payment Collection listings or SST summaries are often required by authorities as supporting documents during submission or audits.

Interested in Getting AutoCount for your Business?

Contact our sales team today to explore pricing options and get started with the perfect solution for you.